Life of a Newbie Trader in Forex is super Interesting. With a lot of eager to make money, you never want to miss out on any chance.

When you read about Forex trading, everything is simple. You may even start to think that your friends may not recognize you after taking 2-3 trades.

Being a Forex trader has been the most challenging thing that ever happened to me.

After having a conversation with my mentor, I made a decision that actually this was the right career I should take.

Why? Because to me, it was a jackpot and seemed very easy to do.

Deposit some money on your account and trade it. Doesn’t it sound easy?

All you need is internet, sit on your computer, analyse charts and place a trade. Or else pay some money for set-up signals and earn $1000 profit.

It is like telling me to close my eyes and my dream comes true. That simple.

Most of the books you will read in this life of newbie trader in forex will tell you how it’s possible to make more than $1000 dollars on a single trade. Tell me if you won’t dare.

However, when you meet any of the successful traders, the life of a trader is completely different.

The life of a newbie trader in forex is very different and complex because all they care about is trade and profit without looking at other factors.

They don’t consider the psychology behind trading.

Here I will explain my life as a newbie trade which I suppose every newbie trader under goes in one way or the other.

life of newbie trader in forex summarized

- Every newbie trader is greedy in the market.

- He/she never wants to lose.

- Most of his/her trades are emotionally based.

- He/she gambles most of the time.

- They are quick to close winning trades and let losing trades run.

- At most, every newbie trader knows and tries out all strategies and trade all.

- All we care about is profits and we trade with no trading plan.

Let’s now explain some details on the avaricious life of newbie trader in Forex,

1. Always in the market ANALYZING charts

As a new trader, my crazy dreams would never let me out of the market.

Since the market is open 24/5 days a week, I never wanted to miss out on any opportunity.

I watched every movement in the market, day and night waiting to grab every opportunity that surfaces.

At some point, newbie traders tend to be market spectators.

You sit in front of your charts, watch every movement a candlestick makes from 1 min to daily as you check every currency pair because you never want to miss out.

You decide to cheer the market. A slight change in color from blue to red, you go crazy.

Sitting in front of the computer and watching the market 24/5 days, does not stop the market from going against you.

The market does not know you with your feelings. It does what it wants at any time it wants.

Instead you spend much of your time in front of your computer and at the end of the day you are fatigued and disappointed.

All you need to know is;

When to trade? what you should trade and how to adjust with market changes in case the trade doesn’t go as expected.

This will help you to spend less time on charts and have more time to attend to other businesses.

2. Trying out several strategies hoping to earn more

As a new trader, you are always finding information here and there, reading all recommended Forex books and joining more Forex trading groups every time you get a chance.

This means you will learn of new strategies and you would want to try out every strategy. I promise you this, every strategy works.

Every time you learn a new strategy, you will try it out and on first 2 to 3 occasions it will work out perfectly. This is so hard to resist.

During this time, you will trade with almost all the indicators at the same time.

Once you make a loss, you drop it as you try out something new. This kind of try out makes you money today and tomorrow gives it back to the market.

In the end you get confused, frustrated and lose confidence in yourself.

Trading several strategies does not make you a successful trader, this you should know. Instead, it gets you frustrated as you watch your account diminish slowly till you blow it.

Every strategy has its own good values and short comings. If you try out different strategies every time you trade, it exposes you to a greater risk.

This is because you don’t know how to deal with it in case a trade doesn’t go as expected.

You need to concentrate on only one strategy, study it, do some back testing and evaluate its performance.

If it fails you completely, you can choose another that matches your trading personality. Only this way, can lead you to trading successfully.

3. Holding more than 10 trades in a single day, closing most in losses

As a newbie trader, all you care about is profit. You never blink as long as a setup shows up in the market.

At the end of the day, you find yourself having a trade on almost every currency pair.

Because you spend much of your time looking at the market, you find yourself trading every set up that appears.

You don’t get time to analyse whether the set up is good or it’s fake. You end up taking large losses due to whipsaw/fake-outs.

Having many open trades does not make you a lot of profit. Take 1-4 trades when you are sure of the risk reward, winning rate and have measures in place, in case a trade fail.

The market will always have many setups but most of them are just fake-outs.

Many open trades can greatly increase draw downs to your account especially if you haven’t considered correlation and position size.

In addition, the losing trades hold your money as margin which would have been used on better opportunities.

4. Moving stops whenever a trade goes against my direction or completely removing it.

Trading with a stop-loss was the most challenging thing I had to deal with as a trader. I may say, it is still a problem to most traders.

This is a very difficult habit to learn as you start trading. But to trade consistently and make profits, you have to tame yourself.

It is very heart breaking and frustrating to enter a trade and after it has hit your stop-loss level, it immediately moves as your prediction and even takes off your target profit.

The pre-mature close of your trades happen often because of our own mistakes as traders.

You either set your stop-loss very close to your entry because you are scared to lose a lot in case a trade doesn’t work out.

So, your trade is left with no space to breath. With just a small movement you are already kicked out of the market.

Or else, your stop levels are set on support and resistance levels. The supports and resistances are price reversal levels. Your stop is hit and price moves back to your predicted direction.

When this happens, you get frustrated and in regret start trading with no stop or move it further on notice that price is about to take it off.

The further you move your stops, the larger the lose, when a trade fails. You cannot do anything about it because you can’t tell the market what to do.

Just close out the failed trade, accept the loss and wait for another opportunity.

5. Closing out winning trades in small profits and letting losing trades run.

As a newbie trader, watching your trade go against you when you have already made some profits is very frustrating.

This is because you are too scared to lose and always take trades with no plan. You would rather close at break-even other than see a price move against you.

When a trade fails, all you do is pray it comes back to break even. By the time you realize that actually a trade has failed, you have made a big loss.

After losing on 2-3 trades, you will find yourself closing out trades pre-maturely taking small profits because you are scared of losing again.

If you can’t accept a loss as part of trading, then you are not ready to trade.

Losses will always occur but what matters is knowing when you should cut your losses and how to bring more odds to your side.

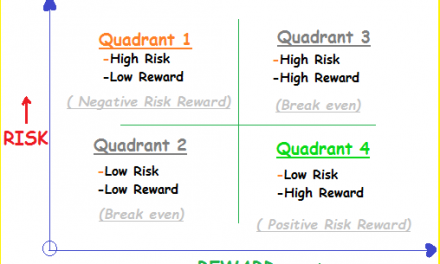

In Forex trading, we always expect two things to happen; a loss or a profit.

Each has equal chances of happening. As you choose a strategy to trade, consider that which will give your more odds with a greater reward.

This way, you will profit even when the number of losing trades are greater than wins.

6. Taking a short-term trade and closing as a long-term trade

As a newbie trader, it is very hard to tell the kind of trader you are. You open a position on a 15 minute chart and close it after 5 days. Of course as a failed trade.

One of the reasons is, you trade with no stop-loss.

Secondary, you never want to lose, so keep holding on a belief that the market will come around and move to your direction.

Holding long on a losing trade limits your chances in the market.

Most of your capital is held as margin for the losing trades.

It also leads to large draw downs on your account.

As you trade, it is very important to know when a trade has failed, for this helps you to cut your losses.

Like i said before, do not spend much time waiting for a failed trade to turn back to your direction but instead close it out and wait on for better opportunities.

7. Trading with no plan

A trading plan is one of the last things a newbie trader would think about.

If at all you manage to make one, it’s another challenge to follow it every time you want to take a position.

First of all, you are always in the market on a watch, waiting for a set up to surface. You never want to miss out anything or else you will chase the market.

You cannot follow your rules when you are always trying out something new every time you trade.

Trading with a plan takes a lot of patience and self discipline.

It is the only way a trader can trade with consistency and profit.

Learn more on how to make a trading plan and why you need a trading plan.

In conclusion, this is a journey that almost all professional traders have gone through. Its not a shame! It is a process!

Work hard to change the bad habits.

We meet on the other side!!