To Trade using Channels in Forex, you must learn to draw proper Channels. Like any other channel you have ever heard of, technical channels are two parallel lines drawn opposite each other.

If you draw an upper trend line and a down trend line at the same time on a trend, you have made a channel. Therefore, the price channels comprise of two trend lines, the upper and the lower trend lines.

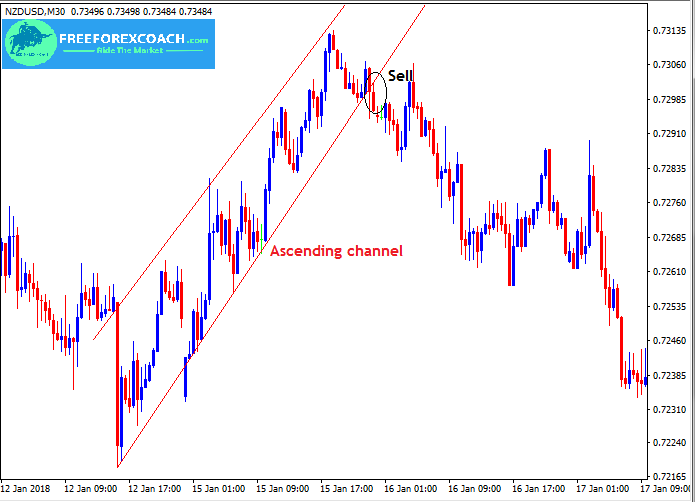

Look at the chart below,

Price moves up and down the channel as it paves its way either in an upward direction, sideways or downward direction. It moves in a zig-zag motion between the levels of support and resistance.

Like supports and resistance and trend lines, channels are also used in technical analysis.

You can use channels to identify the direction of the entire trend.

More so, you can use them to identify potential areas of trade entries for both buy signal and sell signal.

Channels are plotted in the same way as trend lines. You just have to follow the same process as for trendlines. The only difference is that for channels, you draw trendlines on both sides.

Just draw below and above the price trend movement.

The two lines of the channel act as support and resistance levels. It can hold prices just with in the channel till it breaks on either sides showing a change in the direction of the trend.

You can trade using channels in forex when price breaks out of the upper trendline, (buy) or lower trend lines, (sell).

Sell when the price confirms below the bottom line of the channel. Or else, buy when it confirms above the upper line of the channel.

Types of channels

We have mainly 3 types;

- Ascending channel

- Descending channel

- Horizontal channel

Ascending channel: How to trade Using Channels in Forex

Use an ascending channel when price is moving in an upward direction. It will also help you to determine if price is in an uptrend.

A break on an a lower line of the channel may lead to a change in the direction of the trend to the down side.

When this happens, it gives a strong signal for a sell.

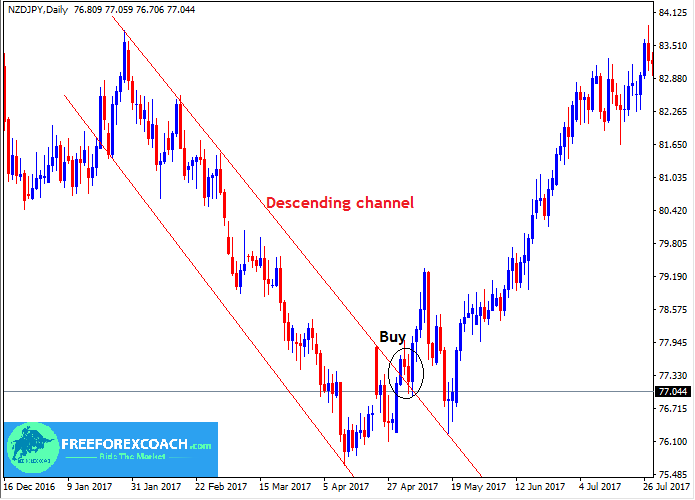

Descending channel: How to trade Using Channels in Forex

You can draw a descending channel when price is trending on a down side . It helps to show the direction of the downtrend.

You can also use it to generate trade signals.

A break on the upper side of the channel gives a signal for a change in the direction of the trend. When this happens, buy the pair.

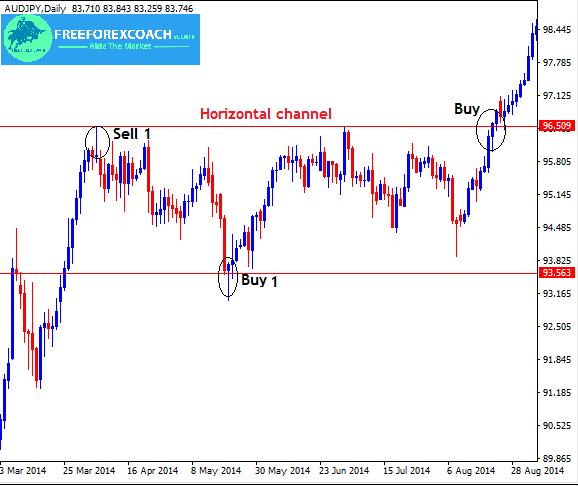

Horizontal channel: How to trade Using Channels in Forex

A horizontal channel shows price moving in the side ways direction. At this point price is ranging or is in a congestion.

A break on the upper side of the channel indicates change in the trend direction to the upper side, therefore a probable uptrend.

On the other hand, a break on the down side of the channel signals a probable downtrend.

Apart from trading a breakout on a horizontal channel, you can also trade price retracements/reversals within the channel as price bounces up and down.

In this case, you buy on support and sell on resistance as indicated on the chart below as sell 1 and buy 1.

Below is a picture on how a horizontal channel looks like on candlestick chart;

important note on how to trade using channels in forex

Price swings up and down within the channel until it gets closer to the either side of the channel line.

When it finally breaks the upper line, it becomes the new support and when it breaks below the lower line, the line becomes the new resistance.

As price paves between the channel marking levels of support and resistance, you can take advantage of it.

Sell on reversal at the upper line of the channel and buy on the bounce of the lower line of the channel.

Your stop levels should be set a few pips below your entry for a buy or above for a sell. Also your first take profit target should be equal to the distance between the two lines of the channel.

However, you can always make some adjustments depending on the price volatility in the market.

Short notes on channels

- You can trade a channel as a break out or reversal.

- Trading a break out on the channel is the same way as trading a support and resistance and trend lines.

- With price breakouts, you can trade using either of the two ways. Enter a trade immediately on the confirmation of the breaking candlestick (aggressive trader). Or else, wait for a retest after the break and enter a trade on the second confirmation(conservative trader).

- A steep channel is less reliable compared to the horizontal one.

- The more attempts price take to break the channel, the stronger and more valid it becomes.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post