Drawdown and maximum drawdown in Forex trading can be measured by taking the difference between the highest amount of your account balance and the next lowest amount of your account balance.

A draw down is the largest loss you make from a trade or consecutive losses before making a profit.

Example

if you are holding an account of $100,000 and trade it to $120,000. Then to $60,000 and finally back to $100,000.

Your amount of draw down would be ($120,000-$60,000) =$60,000. This is equal to 50% draw down.

When you get a 50% draw down, it requires you to make 100% wins on the current account balance to get back our account to break even.

Having a loss in Forex trading is normal and at some point every trader experiences it. Not once , twice but on several occasions.

A loss is something you cannot avoid as long as you open a trade in the market. Because you can never be 100% sure of what may happen in the market.

However much perfect your system may be, it can still cause draw downs to your account.

So seeing a draw down on your account does not mean you are a poor trader or your system doesn’t perform.

However the size of the draw down matters.

Maximum drawdown

Large draw downs mostly happens in times when a trader forgets about their trading plan, or finds it hard to accept a loss on their accounts.

And so they try as much as possible to recover the lost money from their accounts.

They become so desperate and greedy and end up using big position sizes or leverage.

This kind of habit is disastrous.

During this time, a trader is only taken up by his or her emotions and only trades basing on those emotions which can easily wipe out the account.

The major causes of large draw downs

- Poor or no risk management rules.

- Greed.

- Fear to lose money off your account ( Need to make back the lost money very quickly).

- Wanting to revenge back on the market

- Over trading

- Using too much leverage to trade.

Draw downs may be aggregated consecutive losses on your account that may lead to a big loss or a sharp loss on a single trade. For example a 50% and above loss.

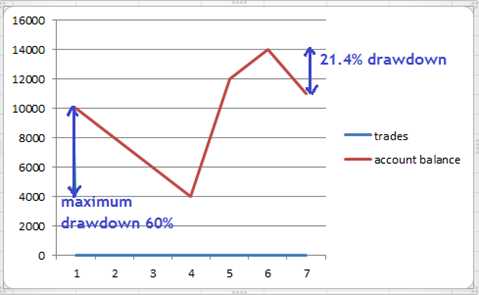

Let’s take a look at another example below.

Example of a draw down

If you have $ 10000 as account balance and you risk let’s say 20% of your money each trade you take.

Risk per trade is (20%×10000) = $ 2000.

Only 3 losing trades are enough to put your account at a verge (60% loss). This is your maximum draw down.

5 consecutive losing trades will blow your account and you are out of the game.

Follow the illustration below.

From the figure above,

Draw down= ($10,000 – $4000)/$10,000 = 0.6 x 100% = 60%

Despite having a draw down on your account, your system should be able to give a positive result even at the periods of your worst peak.

How do you reduce draw downs on your account

Trade with good risk management rules you want to limit drawdown and maximum drawdown in forex.

Determine your stop loss points and appropriate position size before entering any trade.

- Avoid holding on losing trades for long

- Do not risk much of your capital on just one trade . Risk at least 1-3% per trade with a realistic risk reward target and try to be consistent with your risk percentage.

- Using a 2% rule risk management to trade

- Do not fight with the market

- Strictly follow your trading rules

- Avoid trading in high volatile market conditions.

Like we said before, losses cannot be avoided as long as you are in the Forex market.

However, you can reduce the loss. Follow your trading plan to trade and use risk management.

If you make consecutive draw downs, consider revising your trading system and make adjustments if necessary.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post