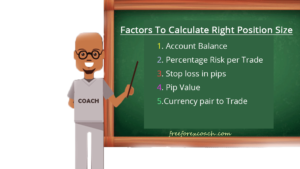

These are factors that you must Consider to calculate right position size in forex for your trades.

In fact, proper position sizing keeps you from risking too much or to little on a trade and blowing up your account

Apart from knowing your entry, stop loss and exit levels, position sizing is the very most important thing every trader must know.

Your position size determines the amount of units you use to buy or sell a currency pair.

We shall further discuss the different factors to consider to calculate the right position size in forex for your trades.

1. your trading capital / Account size.

Knowing your account balance helps you to calculate the correct amount you want to risk per trade in currency.

Assuming you have opened an account with $1000. Your account balance should reflect $1000.

Your account capital can be in any currency denomination you would prefer to hold as a person. It can GBP, NZD, CHF, CYN, JPY, EUR, RAND or USD any of your choice.

Later we shall see how to calculate right position size in forex for different currency denomination.

2. Percentage risk per trade

The percentage risk per trade is the amount of money you are willing to risk from your account for each trade you take.

This is the most important step for determining Forex position size.

Set a percentage amount of your account you’re willing to risk on each trade.

Most professional traders choose to risk 1 to 2% or less of their total capital account on each trade.

Similarly, risking as less as 1% or below keeps your losses small even if you incur several consecutive losses.

At the same time it protects your account from being exposed to too much risk in case of big volatile movements in the market.

Example.

If you have a $1000 trading account. And you decide to risk $10 per trade, that is 1% of your account.

If your risk less than 1% let’s say 0.5% , $5. Or may be 2%

In case you risk 2% from your account for every trade you take, then it would cost you ($1000×2%) =$20 per trade.

What matters here is to risk a percentage you are comfortable with

Choose how much you’re willing to risk on every trade, and keep it consistent. If you choose 1% as your account risk per trade, then you should risk only 1% on every trade.

3. Stop loss in pips

The stop loss in pips is the distance between your entry level point and the stop loss level point.

The stop loss closes out the trade automatically in case you were wrong about the direction of the market.

This helps you to limit big losses from your account.

Stop loss levels may vary with different traders and on different trades due to different trading strategies and market volatility.

Before entering any trade, consider both your entry point and your stop loss location.

Depending on your strategy, decide where to place your stop for your trade.

Measure the distance in pips between your stop loss and your entry price. This will be the number of pips you have at risk for that trade.

If your entry point for a buy on the EUR/USD pair is at 1.22938 and you place your stop loss below entry at 1.22550.

Then your stop loss in pip should be the difference between entry level and stop loss level.

That is; (1.22938 – 1.22550) = 38.8 pips.

This means your trade has to move 38.8 pips against you to be considered a failed trade.

Your stop loss should not be too close to your entry other wise you will be stopped out on a short notice.

Also, you should not put it too wide to avoid big losses in case you are wrong about the market.

Once you know how far away your entry point is from your stop loss, in pips, you can calculate your position size for that trade.

4. pip value per pip

Here you need to first identify the currency in which your account is in.

The currency pair you are trading and the number of units traded/lot size.

We calculate the pip value basing on the quote currency in the currency pair.

How to calculate position size.

Position size = (Account size ×% risk per trade)/ (stop loss in pips × pip value)

What you should know is that position size varies with different lot sizes or account type.

The size on a standard account cannot be the same as that of a mini account nor that of a micro account.

Different examples on Calculate Right Position Size in Forex.

What you should note first is that for all pairs where the USD is a quote/counter currency in the pair, e.g EUR/USD, pip value is the same as indicated;

1000 lot (micro) is worth $0.1 per pip movement. A 10,000 lot (mini) is worth $1. Whereas 100,000 lot (standard) is worth $10 per pip movement.

If the USD is not the quote currency then these pip values will vary slightly. Learn more.

Let’s now look at some examples on how to calculate right position size in forex;

1. When your account capital is not in USD; in EUR

Let’s say your account balance is €1000.

If you are trading a GBP/USD going long, risking 2% per trade and your stop loss is 150 pips

First, you need to convert the amount risked per trade from Euros to US dollar first.

Risk per trade = (1000× 0.02) = €20

Since we need to convert Euros to US dollars, we must know the exchange rate on the EUR/USD.

If the exchange rate is 1.18974.

I.e: USD 1 = EURO 1.18974

FOR €20, (20/1.18974) =$ 16.8

Therefore the risk per trade in USD = $16.8

Position size = Amount risked per trade/( stop loss in pips x pip value)

If it was a Standard account;

Remember, for a standard account (100,000) 1 pip = $10, for all pairs where the USD is a quoted

Substituting into our formula:

= $16.8/(150 x $10)

Position size = 0.01

In case of a mini, 10000 units = $1,

=$16.8/(150 x$ 1)

Position size = 0.11

And if it was a micro, 1000 units = $0.1,

=$16.8/(150 x $0.1)

Position size = 1.12

NOTE: The numerator and the denominator should be of the same currency.

2. Suppose the conversion currency was the base currency in the pair.

For instance trading USD/CHF with our €1000 account using 2% risk with 150 stop loss pips

First we must Convert the EURO to CHF first to get the value of €20 in CHF,

If the exchange rate of EUR/CHF is 1.4500.

Risk per trade = (20 x 1.4500) =CHF 29

Position size = Amount risked per trade/( stop loss in pips x pip value)

If it was a Standard account;

Remember, for a standard account (100,000) 1 pip = $10, for all pairs where the USD is a quoted

Substituting into our formula:

= 29/(150 x 10)

Position size = 0.019

If it was a mini, 10000 units = $1,

=29/(150 x 1)

Position size = 0.19

And if it was a micro, 1000 units = $0.1,

=29/(150 x 0.1)

Position size = 1.93

Note that it is the counter currency you use in conversion of of your account denomination

3. When your account capital is in USD

For instance if the account balance in $10,000.

If you are risking 2% each trade using a stop loss of 200 pips on EUR/USD.

First determine the value of risk amount per trade = (2% ×10,000) =$200

Since the quote currency is the same as the account denomination, you don’t have to convert the risked amount.

So you just substitute in our formula.

Position size = Amount risked per trade/( stop loss in pips x pip value)

If it was a Standard account;

Remember, for a standard account (100,000) 1 pip = $10, for all pairs where the USD is a quoted

Substituting into our formula:

= $200/(200 x $10)

Position size = 0.1

If it was a mini, 10000 units = $1,

=$200/(200 x$ 1)

Position size = 1.0

And if it was a micro, 1000 units = $0.1,

=$200/(200 x $0.1)

Position size = 10.0

I will insist, don’t make things hard for you to trade.

All you need to know is how much you are willing to risk for each trade you take, your stop loss in pips and the average lot value per pip.

You can then easily calculate the proper position size to use on any trade!

How procrastination can affect your trading success?

Procrastination to trade is when your trading set up confirms and you hesitate to take trade. Or your trade show all failing signals and you hesitate to close trade to cut losses. Also, in cases, where you sometimes hesitate to take profit because you want to...

- Oh, bother! No topics were found here.