To trade false breakouts in forex, first you must know common areas where false breakouts or fake outs are likely to happen.

In this lesson, we shall discuss on ways you can trade false breakouts in forex market.

If you consider a breakout to be fake, it simply means it has no or very few chances of keeping in the same direction after a break.

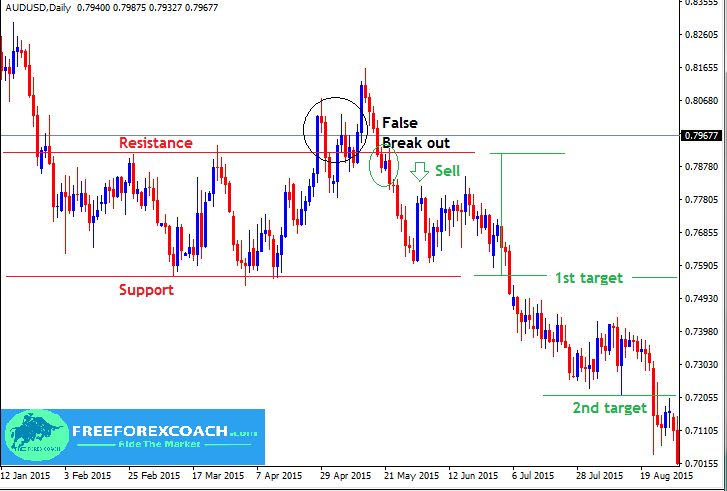

Example of false breakout on a Forex Chart

How do you know/ identify a false break

As mentioned earlier. if you plan to trade false breakouts in forex, first of all you must know common areas where fake outs are likely to happen.

In this case you should watch support and resistance areas, trend line and patterns on which you expect a breakout.

False breakouts occur on all time frames in both trending and ranging markets.

Price may reverse leaving a long pin bar after a breakout or move one candlestick below or above after the break but still reverses back.

However, higher time frames is always the best to consider compared to smaller time frame.

The smaller time frame events have a lot of noise and mostly chaotic.

Therefore using a higher time frame like H4 and Daily may save you a lot of confusion.

How to trade fake outs/ false breakouts in forex

Trading fake outs is a bit tricky because a breakout may fail on its first attempts but end up succeeding in the long run.

With this kind of behavior, you have to trade them as very short term strategies therefore don’t work for long term traders.

When you have mastered how to deal with fake outs you will be able to avoid premature knockouts and losses

You can trade false breakouts in forex the same way as for breakouts .

However, in this case you trade in the opposite direction of the breakout.

Hence treat them as reversal. False breakouts are best traded in the direction of the trend.

Trade after confirmation that it is actually a failed breakout and put a realistic target.

To trade fake outs is not any different from the way we treat reversals.

For instance when price breaks a resistance levels and doesn’t continue in the break out direction, we wait to take a sell position below the resistance.

Let’s take a look at an example below.

In the case above,

Price broke the resistance level but reversed back.

On the first attempt you can see an evening star forming which is a bearish reversal candlestick.

We discussed the significance of reversal candlestick patterns on support and resistance levels therefore you know what that means.

If not, check on our lesson on trading candlesticks with support and resistance.

Sell as price reverses back into the pattern and put your target slightly above the next support.

If price breaks the support level, you can go ahead and take advantage of the breakout too.

What’s important is to cater for your risk reward and take advantage of any opportunities in the market.

What actually causes the fake out/ false breakouts

This question runs in every mind of a novice trader. Do you always wonder why these good breakout set ups turn out to be fake outs?!

Because most traders are looking at these levels of breakouts with high expectations, it tends to be a self fulfilling prophesy.

But since we don’t live in a perfect world, shortcomings appear sometimes and the prophesy is not fulfilled.

Support and resistances levels are looked at as price ceilings and floors.

Therefore, when there is a price break on any of the levels, every trader expects price to first rally in the same direction as the breakout.

If this happens you either buy above the broken resistance or sell below the support expecting big gains.

Due to our greediness by nature we forget to cater for errors and end up in a mess.

We tend to behave as if we are living in a perfect world which is not the case.

So as you look forward to catch up that big move after a breakout you should bear this in mind that breakouts can fail sometimes.

The 5% traders Vs 95% traders on the breakout strategy

What you need to know is that the 5% are the big traders in the market. The 95% are the rest of us.

These guys always find a way to make money from the 95%, the majority small individual traders.

They are also aware of these levels and therefore if everyone has to buy above the resistance or sell below the support there has to be some one to take the other side.

So this is what happens when the big guys take the opposite side of your trades.

You get faked out.

The guys holding these accounts and taking the opposite of these trades are in fact the market makers.

So under such conditions they take the other side of the trade to balance the equation which causes a pull back on the breakout .

This causes most of the small traders get knocked out of the market.

Everyone is smart but when it comes to trading you have to play smarter and behave like the 5% traders.

Trade with the more experienced traders. Join FORUMS to share ideas

That’s how you will increase more odds to your side

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post