Fibonacci retracement in forex trading is a technical analysis method just like support & resistance. Traders use Fibonacci tool to identify different trading signals, entry points, exit points and stop loss levels.

The Fibonacci tool box is comprised of many tools, to list but a few;

- Fibonacci Retracement

- Fib Time Zone

- Fibonacci Fan

- Fib Arcs

- Fibonacci Channels

- Fib extension.

Most traders commonly use Fibonacci Retracement and Extension because they are easy to use compared to the other Fibonacci.

So, now lets put our focus on how to use Fibonacci Retracement in Forex trading.

the Fibonacci Retracement in forex trading

The Fibonacci Retracement comprises of series of sequences that you can use to identify the potential areas of support and resistance.

These sequences were introduced to the West by an Italian mathematician known as Leonardo Pisano Bigollo from Pisa.

He based on certain mathematical relationships expressed as ratios between numbers in a series.

These ratios were used in different fields like biology, music, art and architecture.

The ratios are got from a series of numbers starting with; 0,1,1,2,3,5,8,13,21,34,55,89,144,233,377,610,…..

Fibonacci ratios

The numbers start with 0, then 1. To get the next number, you get the previous number plus the current number, eg the next number is 0+1=1.

And the other numbers are got by adding the two numbers following each other. So the next numbers in the sequence are , (1+1=2),(1+2=3),(2+3=5),( 3+5=8),(5+8=13),(8+13=21)…to infinity.

If you divide a number with the previous numbers, you get an approximate value equal to 1.618. For example 34/21 =1.6190, 55/34=1.6176, 89/55=1.6181, 144/89=1.6179.

Divide a number by the next number, you get an approximate value equal to 0.618. For example; 13/21=0.619, 21/34=0.6176, 34/55=0.6181, 55/89=0.6179, 89/144=0.6180,……..

And if you divide a number by a number two places higher, you get an approximate value equal to 0.3820 For example 13/34=0.382, 21/55=0.3818, 34/89=0.3820, 55/144=0.3819,…

Also If you divide a number by another three places higher, the approximate value will be 0.2360. E.g 34/144=0.2361, 21/89=0.2359, 55/233=0.2360,……

The 1.618 is also known as the Golden Ratio/ Golden Mean or Phi.

The good news is,

You will not have to calculate all these ratios because they are provided on the chart tools software. However, if you’re curious, you can use the Fibonacci calculator to calculate the ratios.

But the above calculations were to show you how these ratios are derived so that you don’t get confused when you see them on the chart.

What’s important is to know how to use them and when.

Fibonacci retracement and extension levels

The commonly used ratios are;

0.236, 0.382, 0.500, 0.618 Retracement levels.

The levels help traders to identify where and when the market reverses before it continue in its former direction.

Levels are usually expressed in percentages as 23.6%, 38.2%, 50%, 61.8% and 100% for easy use.

Price tends to pause or reverse as it approaches Fibonacci points above. Therefore Fibonacci levels behave the same way as support and resistance .

Traders mainly use these levels to determine targets, entry points, exit points and the stop loss order.

Some traders use Fibonacci Retracement only while others use both Retracement and the extension levels. We will discuss all that in the next sessions.

0, 0.382, 0.618, 1.000, 1.382, 1.618 are the main extension levels.

Fibonacci extension levels are also expressed as percentages. That is 38.2%, 61.8%, 100%, 138.2%, and 161.8%.

They help traders to know how far prices are likely to go compared to the previous swings so as to get the right target profit levels.

These are mainly used to determine targets, especially take profit target.

How to draw & use fibonacci retracement in forex trading

To draw the Fibonacci Retracement;

- Identify two extreme points on a swing high and low.

- Drag the line to join the two points.

- The vertical line displays Fibonacci retracement ratio levels which range from 0.0% to 100% .

When you are to use the Fibonacci Retracement tool on your chart,

- Select the Fibonacci retracement tool on your chart or trading platform on the MT4.

- Go to Insert >Fibonacci>Retracement, or simply click on the icon on the toolbar

.

.

The tool has 0 and 100 levels in addition to other levels we mentioned earlier. 0 and 100 mark the end and starting point of a price wave.

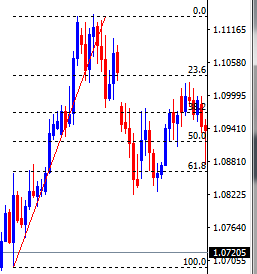

When trading in an uptrend, extend the tool upwards from the starting point to the high of a price wave. The 0.0 should be at the wave high and the 100 at the wave low.

This is how it should appear

How to use fibonacci retracement in an uptrend

A pull back is when price moves in the opposite direction of the main trend.

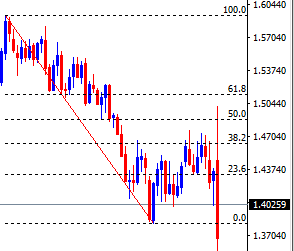

How to use fibonacci retracement in a downtrend

When trend is down, extend the tool downwards from the starting point to the low of a price wave. The 0.0 should be at the wave low and the 100 at the wave high.

This is how it should appear.

From the this chart, price pulled back at 0.0% from the low of the main wave(impulse wave) which is 0.0% Fibonacci retracement level.

It retraced the 38.2% .

If it pulls back 61.8% it is at the 61.8% Fibonacci level.

The 61.8% level mean the price has retraced much of the prior move and 100% makes a complete wave retracement.

Levels such as 23.6% and 38.2% mean the price has only retraced a small portion of the prior move.

In a very strong trend, you are likely to see shallow pullbacks to 23.6%, 38.2% and sometimes 50.0%.

But when a trend has moved for sometime, for example during the middle or towards the end of a trend, retracements/pullbacks are likely to hit the 61.8 or 78.6 levels.

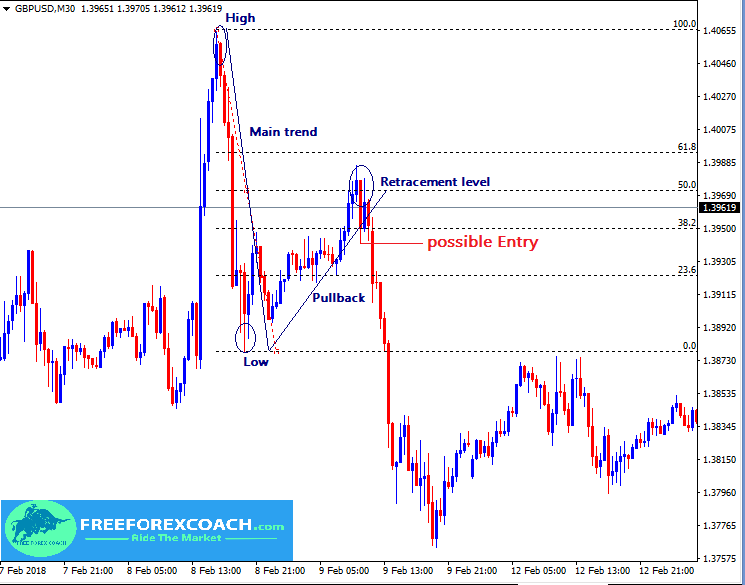

The chart below shows Fibonacci retracement in a strong downtrend, GBP/USD,M30 Chart.

Once you have learnt how Fibonacci tool works, you can use it to watch potential areas on the market where price always hold and reverse and rely on that to determine your entry signals.

In the next lesson we shall look at how to use Fibonacci retracements in forex trading to enter a trade.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post