To Trade News in Forex, you must first know where to find this news and how to interpret the news.

The global economic news release is always put on the economic calendar and is easy to access online.

However, sometimes most brokers provide fundamental news to traders for free on their trading platforms or by email.

The news events on the economic calendar are scheduled monthly or quarterly. It is released repeatedly every months same days of the week.

It is always important to checkout the daily news events before making any decisions to take a trade or as you monitor your running trades.

The Economic Calendar

The economic calendar shows the previous news release for last month, the forecast and the actual news release.

This provides a basis for comparisons to gauge the performance of the country’s economy before taking any position.

ForeCasted data: This is the figure determined by economist before the actual news are release.

Actual figure: The real news release from the source at the scheduled date.

Deviation: is the difference between the actual release figure and the forecasted figure.

How to interpret news release on the economic calendar

Once you know the news to trade on the economic calendar, interpret the figures and relate it to the market.

When the actual news release is better than forecast news, we expect the currency to appreciate. Therefore the market will rally upwards.

On the other hand, when the actual news release is less than the expected, we expect the market to fall to the downside. This is because the currency loses it’s value.

When trading news;

If the actual news is greater than the expected news, holding other factors constant, the currency in question appreciates and the market becomes more bullish.

So we expect a strong uptrend.

Buy the pair. The opposite is true.

Example on how to trade News in Forex;

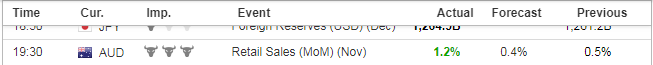

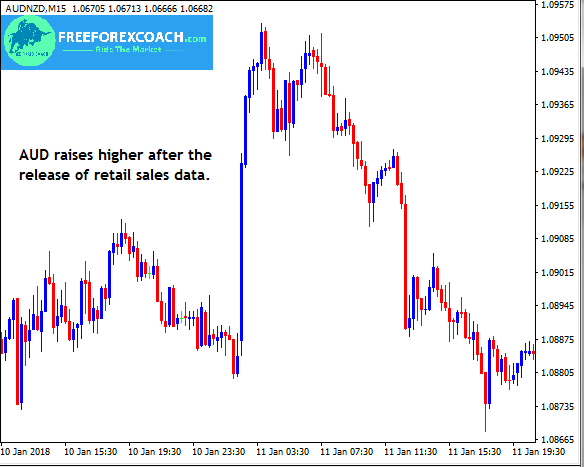

Retail Sales News Release

The example below shows what happened in the market after the release of retail sales in Australia. It was more than expected.

The AUD/NZD advanced from 1.08839 to 1.09533 covering 69.1 pips within 15 minutes after economic data in Australia favoring the AUD .

Australian retail sales was 1.2% more than forecast, 0.4% with a 0.8% advance.

News Interpretation

The positive retail sales data is a signal for a healthy economy and a future economic development.

This attracts more foreign investors into the country.

It also increases the value of AUD hence strengthens the currency

If this happens in any economy,go long on the pair.

It is also important to consider other news released in the same time zone. This helps you to get a clear picture of the economy when you consider the aggregate of the news.

For example,

If there is one big influential news data release and many other moderate news release at the same time, the aggregate of the other news can make a great impact to the market.

So you need to watch out for that too to trade news in forex.

Trading the aggregate news release

Let’s take a look at a scenario where different news are released at the same time from different economies affecting one pair.

Example: NFP and Unemployment Rate

In case of negative data such as unemployment rate

A higher than expected reading should be taken as negative/bearish and lower less than expected, as positive/ bullish.

For NFP.

A lower than expected reading should be taken as negative/bearish and higher than expected, as positive/ bullish.

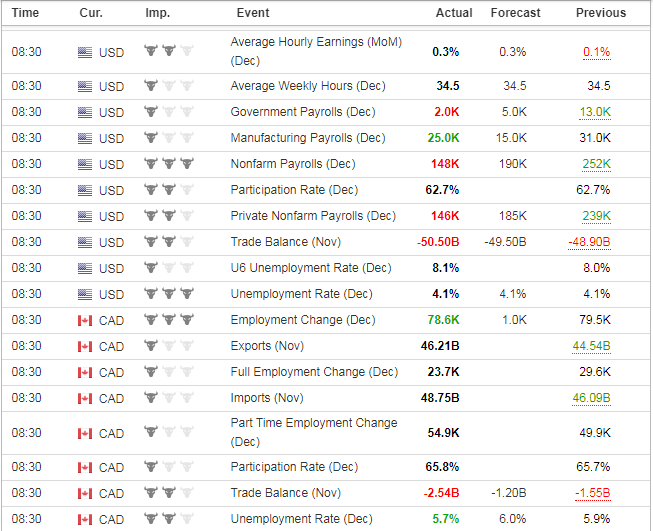

Calendar

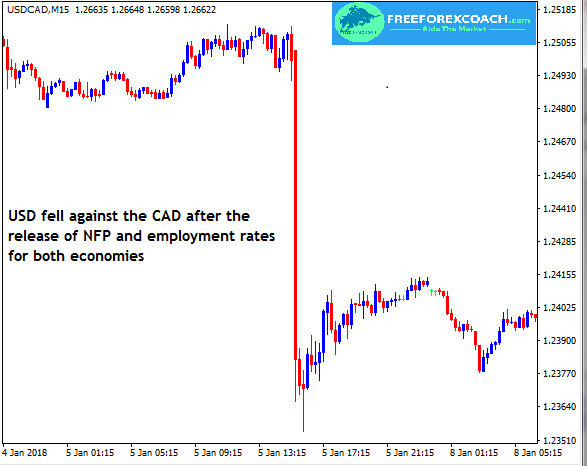

Chart

The USD/CAD fell from 1.25121 to 1.23539 moving 158.2pips in just 15 minutes after Statistics Canada released the December jobs report.

CAD news Interpretation

The Canadian unemployment rate fell to its lowest reading in 40 years.

The number of jobs added to the economy in December were 78,600 much higher than the forecasted 1,000.

Unemployment rate fell from 5.9% to 5.7% and was 3% less than the forecasted.

The increased number of jobs added in Canada’s economy is a good sign for a productive future economy.

Investors become so confident to invest in the economy hence strengthening the CAD.

USD News Interpretation

NFP data turned out negative with only 148000 jobs created less than the previous month which was 252000 jobs.

It was also less than the forecasted jobs which was 190000 jobs with a difference of 42000 jobs.

Although unemployment rate was constant as the previous and forecasted at 1.4%, this was not enough to save the USA economy.

The other news release from the USA economy was also not in favor the USA economy and this made the dollar fall badly against the CAD.

How do you trade news release/take entries

There are 3 main ways to trade news in forex market.

1. Place a trade before the news release with in 5-10 minutes to the time of news.

Analyse the market before the news release.

Compare both the technical and market sentiment and see what they are trying to tell you at the moment.

Consider and pay attention to the recent news announcements in the market and the market reaction.

If they all pointing to the same direction, place a trade 5-10 min before the news release taking direction according to your analysis and set your stop loss accordingly.

If you are wrong according to the economic calendar reviews, your stop is likely to be hit and you are out.

2. Place a trade after news release

Taking a trade at least 5min after the news release.

Here you enter a position after the news release. You are actually trading the news results.

After your market analysis, wait for the news to be released, then take trade.

With this you are likely to face challenges with big spreads or sometimes delays in execution.

Place a trade in the direction of the market and put a stop loss.

3. trade the two way; before and after the news release.

Some traders trade news both before and after the news release.

If you have put a trade before the news release and after the news the market goes your direction, you can add more trades by scaling in and trailing your stops.

With this you can catch more pips in the market by taking advantage of the news.

Trading news is not as that simple as it sounds. You are either right or out of the market.

So, whatever way you use to trade news carry on your risk management tools and don’t be so greedy.

But there are sometimes when the news is released and the analysed results don’t match the market movement.

This is why!! The Big market Players

How the big market players influence news release

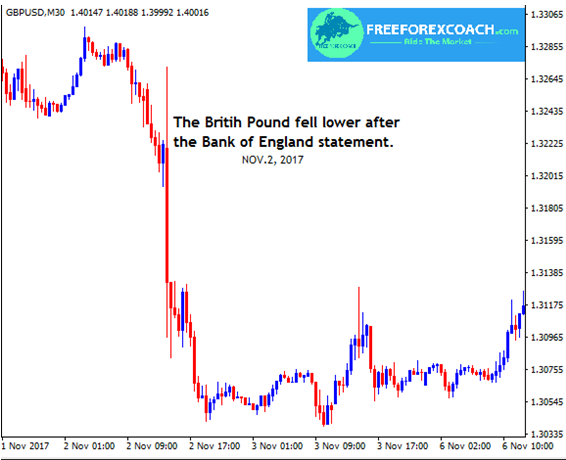

Example: The expected hike in interest rates by Bank of England Nov 2, 2017.

From the economic calendar the previous rate was at 0.25% and expected to rise to 0.5%.

This means that all big market players predicted a raise in the interest rate by the BOE to 0.5% and so a strong Pound.

Therefore,they adjusted their accounts according to the predicted rate and took more long positions before the actual news release.

When the actual news was released, it turned out to be as expected 0.5%.

To the retail traders, it was a great signal for the strengthening pound therefore time to buy the pound.

Unfortunately, as most traders took their positions the market suddenly moved to the opposite direction instead of taking the news direction.

Why?

Because the big guys/big market makers had already adjusted their positions. In fact, at the time of news release, they were closing out their open positions taking profits.

This why the market moved to a different direction.

So most of the traders who took long positions trading in the direction of the news lost money.

This is what actually happened in the market.

Take a look.

A part from the hike of interest rate,

There was also high inflation rate, low production levels and the Brexit crisis.

This all contributed to the continuous fall of the GBP.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post