CPI in Forex is one of the indicators traders can rely on to gauge level of inflation in consumer goods

Consumer price index (CPI) is a measure that examines the weighted average of changes in prices of consumer goods and services each household bought in a certain period of time.

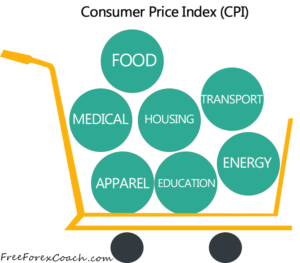

CPI averages price changes of a basket of goods and services that households can purchase.

These include; transport, food, medical care, education, housing and recreation excluding taxes.

Changes in the CPI is then used to assess price changes associated with the cost of living.

The CPI is measured using 2 index:

- The CPI-U which measures CPI for urban consumers

- CPI-W which measures CPI for urban wage earners and clerical workers.

CPI is one of the most important indicators that investors, government and analysts can rely on to gauge the level of inflation in consumer goods.

The Consumer Price Index(CPI) measures inflation within an economy in relation to the cost of goods and services.

How does CPI affect the Country’s economy

Like we saw before, CPI is a major indicator that evaluates the level of inflation in consumer goods. Therefore changes in the CPI can have a great effect on the economy.

When the CPI of a country continues to increase,

Consumers are discouraged to save and their purchasing power falls.

This is a sign of inflation and may result to a fall in the value of currency.

As a result the Central bank is likely to raise interest rates to curb down the inflation pressure. This makes borrowing expensive and backs up the currency value.

On the other hand,

a fall in CPI discourage consumers from spending especially buying luxury goods / non-essential items.

Because they expect prices to continue falling they tend to save money by waiting for prices to be cheaper.

Lower consumer spending may lead to lower economic growth hence more deflationary pressure in the economy.

Due economic slowdown in the country,the central bank reacts and cuts interest rates to encourage borrowing for investments and expenditure.

How CPI in Forex affects the market.

Traders use the changes in the CPI data release to assess the strength of currency in the forex market.

Changes in the CPI determine the levels of inflation. It also influences the decisions taken on the interest rate hence a major determinant of the value of currency.

When the CPI or Core CPI comes out higher than expected,

the currency increases in value relative to other currencies and the forex market becomes more bullish.

This is because,High CPI reflects economic growth and inflation.

As inflation continues to grow, the central bank is likely to hike interest rates which results to currency appreciation.

When the CPI or Core CPI comes out less than expected,

the currency value falls relative to other currencies. The forex market becomes more bearish.

Low CPI reflects Low inflation and a slow down in the economy.

Further fall in CPI may force the Central banks to cut down interest rate in order to encourage borrowing and expenditure to boost the economy.

Traders mostly focus on core CPI data because it excludes more volatile price changes in food and energy commodities.

CPI in forex data Release

CPI release dates usually occur every month, but some countries may release the data quarterly and sometimes yearly.

The US Bureau of Labor Statistics reports the CPI data every month.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post