To create consistency in trading forex is not something you can easily achieve but if you put your efforts; it’s achievable. It takes discipline, patience, practice and a clear state of mind. You must be willing to continuously devote yourself to a system and a routine to trade.

Consistency in trading simply means following the same routine or trading principals over and over again to achieve a stable profit with small losses.

For example, as a trader, if you take 10 trades every day, and out of 10, 7 win and 3 lose for 5 consecutive days, your system is good. To become a consistent trader, you should be able to maintain your performance every time you trade

Simple Tips on how to achieve Consistency in Trading.

Have a trading strategy and set trading rules

To achieve consistency in trading, you must first of all own a trading strategy to trade. Your trading strategy must be clear, simple and fit your personality. It should contain all the details of how you will trade, when, what and where to trade.

In addition, you must include how you are supposed to react when in different market conditions.

This includes;

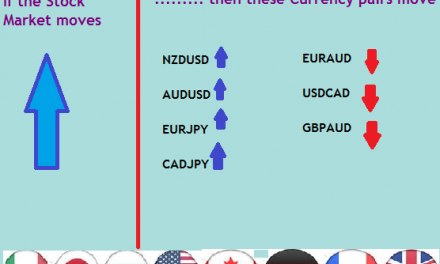

- What currency pairs you should consider to trade

- On what time frame should you trade.

- Details of when to enter a trade and when not

- It should include your risk to reward ratio

- Position size

- How much are you willing to lose

- And how to react when a trade fails, hits stop loss or reaches your target.

All in all a trading strategy acts as your guidelines to trade and also helps you to know if your system is working or not.

Set rules to trade and obediently follow your trading rules.

It’s one thing to set rules and it’s another thing to follow them. If you are to be genuine to yourself, how many times have you followed your trading rules or broken them. It’s obvious, the later weighs more.

Many traders set rules. A few go ahead and put them in writing but the majority never follow them. At least, you try it on the first day, second third and then next time you don’t know what happened. Rules suck! I know. But trust me, after you have drawn your account to zero, then you realize that however much rules such, they are very important.

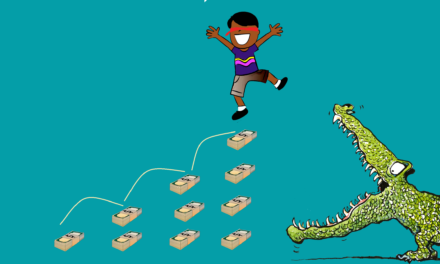

Without your trading rules, you become irregular in the market. You start to make irrational decisions. For instance, letting a trade turn into bigger loss, jumping the gun or trading too large position in relation to your account balance.

You can never see consistency on your account if you are trading like that. Instead, not trading your rules will cost your account.

To achieve consistency in trading, you need to stick to your trading strategy and obediently follow your rules to trade.

Use risk management

Risk management plays a very important role to achieving consistency in trading. With risk management, you can regulate level of loss when trading. It also protects you from large losses. Risk management covers, your risk to reward ratio, position size and how much you want to risk on a single trade.

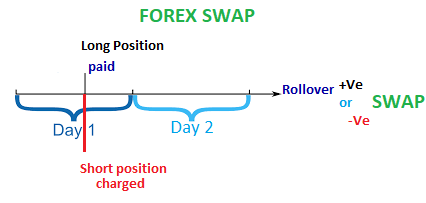

First, you must adopt to trading with a stop loss on every single trade you take. The fact is, you never know what may happen in the market at any given time.

A stop loss is the only thing that will save you from large losses in case the market does not go to your prediction. However, your stop loss should not be so close to suffocate your entry nor too large to cause a big loss.

It should be enough for your trade to breath and fit your risk.

Recognize your mistakes and continue learning.

To overcome your trading errors/ mistakes, you must acknowledge them first. It’s the mistakes we make that cause our trading losses and inconsistency.

If you’re going to become a consistent winner, you must know that mistakes are part of the trading process.

Develop a habit where you keep observing yourself every actions/decisions you make in the market.

Review yourself once in a while. Find out where you went wrong on failed trades. Compare your failed trades with wins and find out what you did wrong. Your mistakes should act as indicators to show you where you need to improve. How much effort you need to put in to achieve what you want.

For example if you made a loss because you took an entry early, when the next opportunity shows up in the market, wait for your setup to confirm. Then take your trade. Do it again and again every time you trade. as long as you know what the cause of your failing is, you can easily get rid of it. It may not be simple but keep practicing until it becomes part of you.