Head and Shoulders Pattern in Forex is the most popular chart pattern traded in the market.

It forms after an extended uptrend movement with three price peaks at different levels.

Therefore, it is a bearish reversal pattern. It is easy to spot on the chart and can form on all time frames.

What is a head and shoulders pattern in forex?

Like the name suggests, the head and shoulders appears in formation of a human head and shoulders.

It consists of 3 price peaks;

- The head,

- Left shoulder

- Right shoulder.

The center peak(head) is highest and other two peaks lower giving it the shape of a head and shoulders.

The left and right shoulder peaks are almost of same price level zone and same distance from the head.

However, it may not always be that perfect. But they should at least be comparable.

When you draw a horizontal line connecting the lows of the left shoulder, the head and the right shoulder, you get a support line.

This support line is also known as the neckline.

Head and Shoulders Pattern on A Forex Chart

The formation of a head and shoulder pattern in forex uptrend signals the completion of the trend and the probable change in price direction to the downside.

The pattern is complete after the break and close of a bearish candlestick below the neckline. This confirms the Sell signal.

Confirmation of the Pattern.

NOTE: Formation of the right shoulder DOES NOT confirm the head & shoulders entry signal. Always wait for Neckline Breakout!!

BREAKOUT ON THE NECKLINE

The pattern is valid when the price action on the right shoulder breaks the Neck Line with a bearish candlestick closing below the neckline.

You can also consider a price retest after the breakout for extra confirmation.

Then trade the pattern in the direction of the breakout which is the downtrend direction.

Always wait for the break of the Neckline to confirm entry to avoid false breaks.

How to trade the head and shoulders pattern

Guidelines to trade Head and Shoulders Pattern in Forex

- Identify an uptrend

- Spot the head and shoulder, draw the Neck Line connecting the lows .

- Then Wait for the price Breakout on completion of the right shoulder on the neckline.

- Take trade/sell as the price breaks and closes below the Neck Line with a bearish candlesticks.

In case you are a conservative trader, wait for a price retest after the price break on the neckline. Take entry on the second breakout confirmation.

Stop Loss and Take Profit Levels

For SL: Put your stop level slightly above the right shoulder in the pattern.

For TP: Measure the size of the pattern(height) from the neckline to the head high and then apply the same distance to the downside starting from the Neck Line.

This would be your minimum target profit.

examples on how to trade a head and shoulders patterns

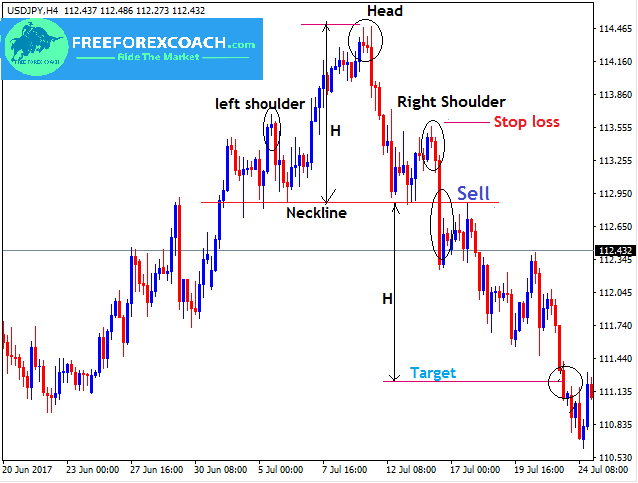

Example 1: USDJPY, 4-Hour chart.

As we discussed previously,

Confirmation for the sell entry is the break and close of bearish candle below the Neckline as shown on the chart above.

Stop loss is set just above the right shoulder and target measured and set as shown above i.e

Measuring vertical distance H from Head to Neckline and projecting that same distance H downwards as the profit Target as shown above.

Example 2: AUDUSD, 4-Hour chart below.

From the Chart above;

Sell signal was at break & close below the neckline (support line).

The Stop loss just above the right shoulder .

The target was got by simply measuring the height of the pattern (H) and projecting that same distance from the neckline downwards.

However, Stop-loss and target profits can also be adjusted depending on your preferred risk reward ratio.

But for starters, better to trade it traditionally as you get used to new ways of adjusting the Stops and profit targets.

Let us now discuss the Inverse Head & shoulders

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post