As a trader, if you can master the how to trade with the trend, then you have mastered the flow of price movement in the forex market. To trade with the trend is to trade in the direction of price movement.

Prices in the forex market can move upwards, uptrend. Down wards, downtrend or sideways which is commonly known as the ranging market.

When price is trending down, look for sell opportunities. When price is trending up, look for buy opportunities. Or else, buy or sell when price is moving sideways.

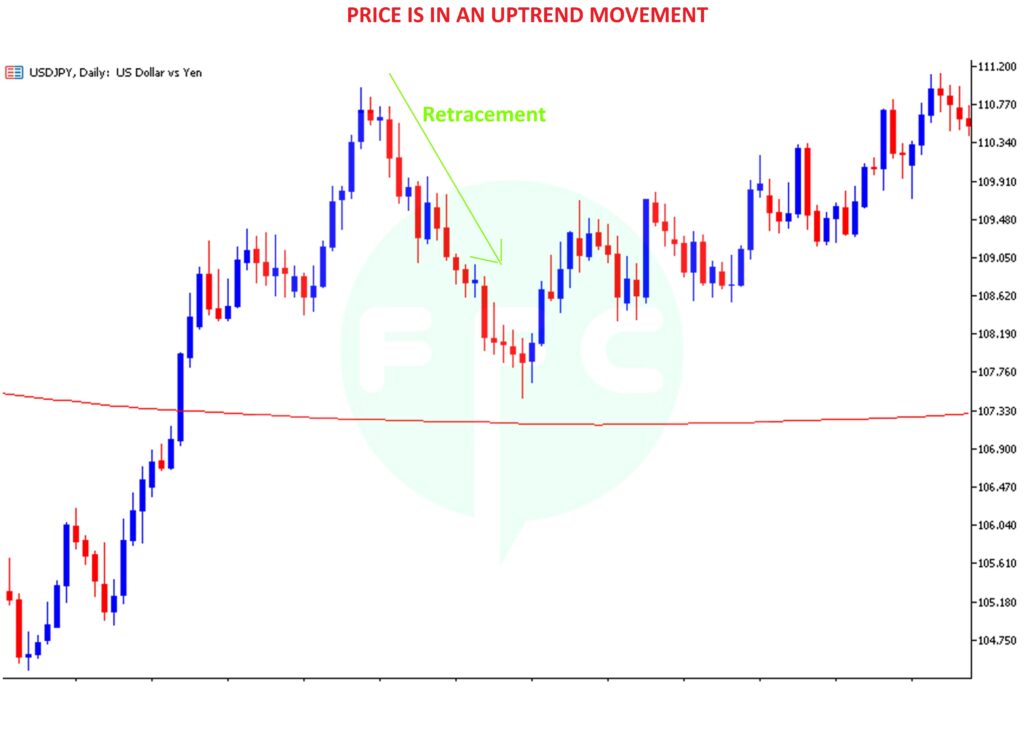

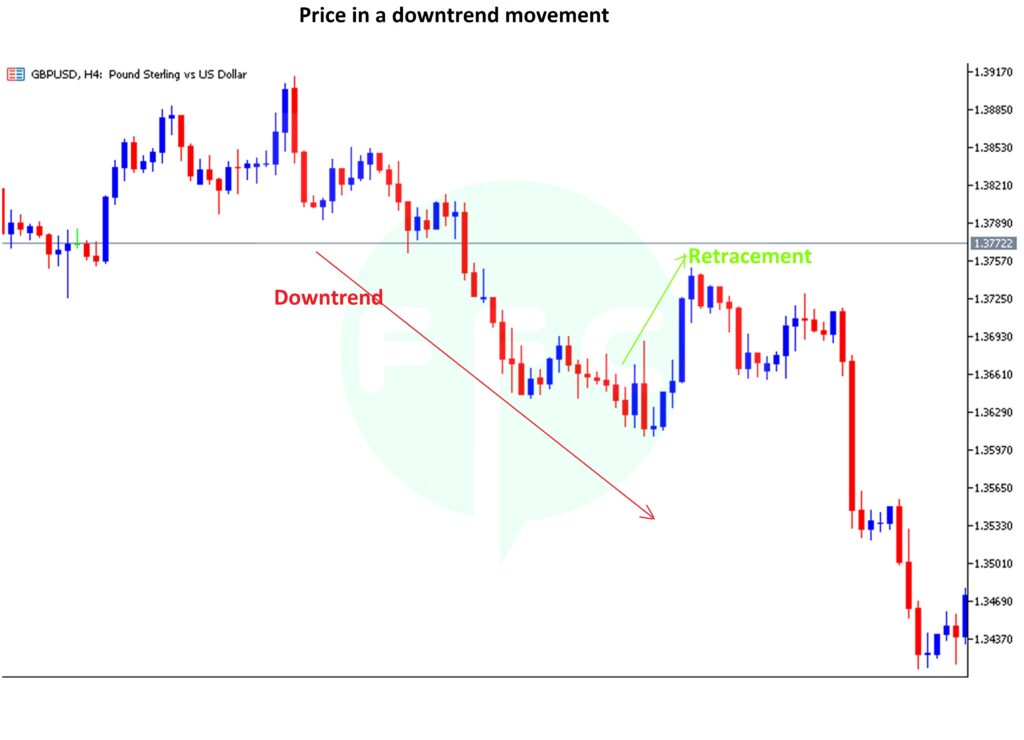

Certainly, prices in the forex market can never move in one direction for a long period of time. At some point prices in the market move higher and then pull back to the downside and later resume in the former direction. These small pullbacks are the price retracements.

After a very strong movement in the market, prices congest or pullback. At this point, there are traders who haven’t decided yet whether to continue buying. Price retracements last for a very short time as traders’ decisions get clear, the market then resumes its trend direction.

How do you determine the major trend and trade with a trend?

How to determine the major trend?

To determine a trend, you need to first look at the direction of the major trend. For intra- day traders, mainly look at the daily chart. First get to know what exactly is happening.

If price is moving up on a daily chart, it’s an uptrend. And if price on a daily chart is trending down, that’s a downtrend. The larger the time frame, the more valid it is.

How to trade with a trend?

If price is in an uptrend on a higher time frame, in this case daily time frame, wait for price to retrace/ pull back and then buy on support. On the other hand, if price is trending down, wait for a pull back up and then sell on resistance. Your trading setup should be on a lower time frame.

Your trading edge should define what you consider as support or resistance. Also set stops and profit targets in relation to your trading setup risk reward ratio.

Difference between a reversal and a retracement.

Retracements are temporary price reversal within the major trend. Reversal is a change in the direction of the entire trend.

Retracements happen more often in a trend and last for a very short time. Reversals on the other hand, price is likely to move in that direction for a long time.

For an uptrend, a retracement occurs when price is moving up, then pulls back down for a short time and later continues in its initial direction. That pullback to the downside is a retracement.

On contrary, when price is trending down, then suddenly moves up shortly and later continues in its initial direction, it’s a retracement.

It is very important to know how to distinguish a retracement from a reversal to trade with the trend.

This will save you from taking fake signals hence losses.

Common indicators, that it’s a retracement

For a retracement, prices commonly hold on support or resistance on a smaller time frame

Price is likely to form small candlestick patterns indicating indecision in the market.

- Retracements last for a very short time

- Take place in the middle of a trend or when a trend has just started.

- A retracement is just a few candlesticks opposite direction of the main trend.

- Usually occur after a strong price volatility and volume.

Common indicators that it is a reversal;

A reversal is a change in the entire direction of a trend.

- Price continues in the same direction for a while when a trend has reversed.

- It normally occurs after a long price movement or periods of price exhaustion.

- Normally, you see a decline in price momentum and volatility and again but to the opposite direction.

- Formation of reversal candlestick patterns.

- Support and resistance on a larger time frame.

What should you do when you see these indicators?

If you are watching an uptrend and you notice that price is on retracement, mark your next support on a chart. Then buy as price changes back to its initial direction.

For a downtrend, sell if price hits your resistance level after retracement.

However, if you have a short position and you notice signals for a trend reversal, it’s a perfect time for you to close that trade. The reverse is true for an uptrend trading.

To trade with the trend simply means you trade following the trend movement. If you are in an uptrend and the trend reverse, you have to close your trades and look for new opportunities in the down trend. Unless you do that, you won’t make any profits.

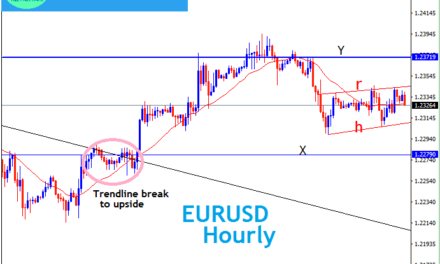

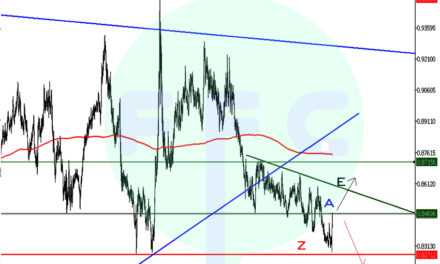

There are tools and indicators you can use to identify retracements and reversals. For example, Fibonacci Retracement and trend lines.

You can also use a moving average indicator or the Bollinger bands. All work almost the same way. Just master one and stick with that.