Another way to trade is to use Moving Averages as support and resistance levels.

In the previous lessons, we discussed how to identify trends with moving averages, and how to use moving average crossovers. Now, we shall look at how to use moving averages as dynamic support and resistance.

Using a moving average is different from the traditional horizontal or diagonal lines of support & resistance levels.

It is referred to as dynamic because it measures resistance and support using moving averages that float along with market changes.

You can establish a dynamic support & resistance when price rejects or intersects with a particular moving average. Also,the dynamic support and resistance tend to change as price changes.

For the case of horizontal or diagonal lines of support & resistance levels, if you are not familiar with them by now, i will refer you back to our previous lesson on support and resistance.

How to use moving average as dynamic support & resistance.

Moving average support and resistance isn’t as powerful as horizontal levels, but when you combine it with other indicators, the result is magical.

The fact that most traders use these Moving Averages to trade, it means most traders are watching these levels. Why? because they believe in them.

What happens is, that price also starts to respect these Moving Averages and it becomes a self fulfilling prophesy.

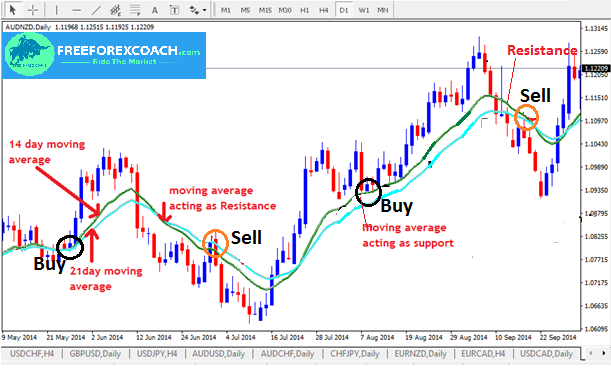

Let’s take a look at the chart below.

From the above AUDUSD, Daily forex Chart;

For Up trend,

Price paves above the Moving Average. As price dips and tests the Moving Average several times, it finds support at the Moving Average. So we can buy on a bounce of prices from the moving average.

If it is a Down trend,

Price will pave below the moving average. As price rises and touches the Moving Average, it finds resistance so we can sell as price fall off the moving average.

Though the Moving Averages are not as perfect as the normal support and resistance, they behave the same way.

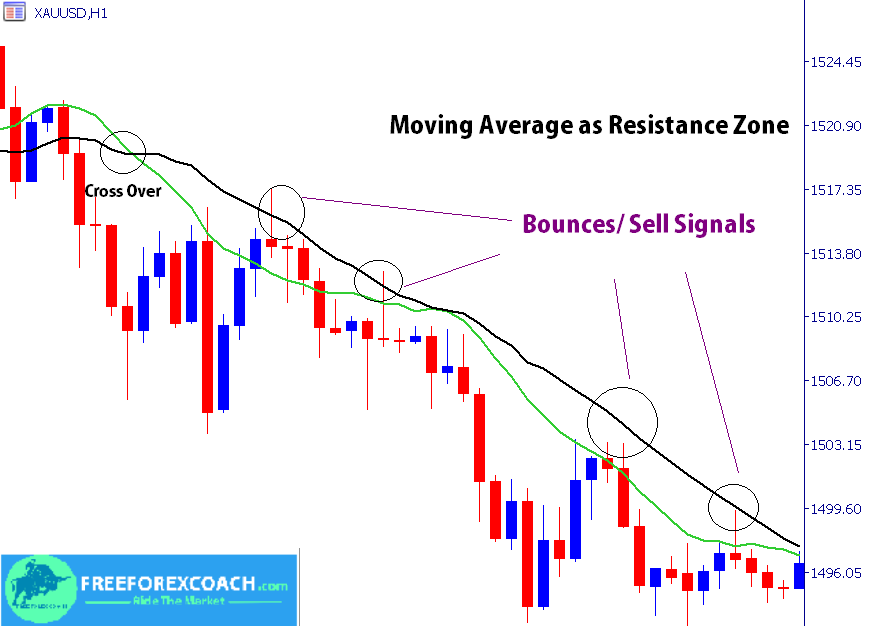

Moving average as a dynamic resistance

When price holds below the Moving Average several times , it shows high selling pressure in the market. Therefore, price finds it hard to breakthrough.

The sellers are stronger than buyers.

Mean while, the Moving Average above the price becomes a resistance.

Price is likely to bounce back on moving average resistance hence giving a sell signal.

When this happens, you can trigger out your sell position at the pull back/ or bounce holding other factors constant.

On contrary, price will not always hold at these levels all the time. So it is not a must that price will always pull back at resistance. A price break can also happen.

Like the normal horizontal or diagonal resistance, you can choose to sell at price bounce or buy on breakout.

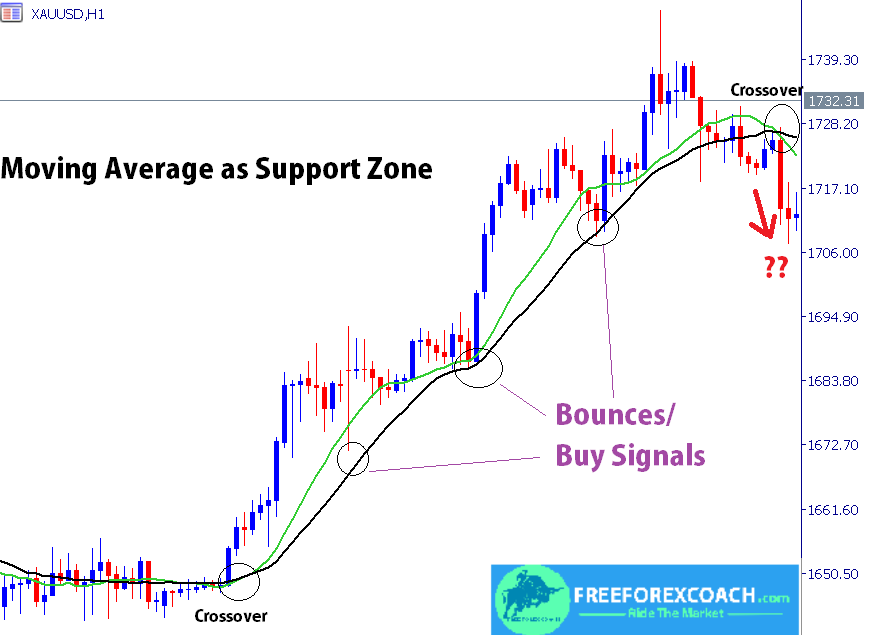

Moving average as dynamic support

Likewise when price holds above the moving average several times, it becomes a support and there fore is likely to bounce back giving a buy signal..

This shows high buying pressure in the market. Therefore, price finds it hard to breakthrough.

The buyers are stronger than sellers.

When this happens, you can trigger out your buy position at the pull back/ or bounce holding other factors constant.

So, When you see a pullback, prepare to buy.

Also, you can trade breakouts on dynamic moving average support. When price breaks through a support, it gives a sell signal. Therefore you take advantage of all the opportunities as long as it is part of your trading strategy.

Remember, to successfully trade breakouts on support and resistance, you have to wait for a confirmation breakout candlestick close before you take a position.

Another way to trade a break out is to wait for a price retest after the break to avoid a fake out. Position yourself with stop loss and make use of risk management to limit your losses.

The most preferred way is trade in direction of the main trend i.e the bounces off the moving average support/ resistance

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post