Multiple Time Frames Analysis in Forex means to simply compare price moves of same currency pair on different time frames to find better entry & exits

Multiple time frame analysis is analysing charts starting with a bigger time frame going down to a smaller time frame.

Once you have the time frame you want to trade, then compare it with a higher time frame and a lower time frame.

The bigger time frame helps you define important levels of support and resistance and the current price swing of the main trend.

The lower time frame will help you to know the current movement and how it is reacting to strong support and resistance zone and give entry signal confirmation.

Therefore comparing the two time frames with the one that carries your trading set up, you will be able to get a clear picture whether you should take a trade or not.

Or whether you should exit or not.

Now let’s take step by step and take you through a multi time frames analysis in forex.

How to analyse the market on three time frames

We shall take our analysis on NZDUSD and we are trading on a 30 minute chart.

We shall look at H4 as the larger time frame and 15 minute chart as a smaller time frame.

Let’s carry on;

looking at a larger time frame

- Identify the current swing of the main trend; It can either be bullish or bearish. This helps you to analyse the potential market direction a head for the over all trend.

- Identify and mark potential trading areas such as support and resistance levels or swing highs and lows.

As a trader you should always aim at trading in the direction of the main trend. The bigger time frame is more reliable.

NZDUSD, H4 multi time frames analysis in Forex

In this chart above, the market has been trending upwards since 7th December 2017 making successful higher highs and higher lows.

This indicates that the buyers are still dominating the market and are still in control.

If we go long on the pair, we are at a greater advantage than shorting it . The trend is still strong to the upside.

Now, let’s look at our trading set up to see if it qualifies for a valid set up.

The trading time frame – Multi time analysis

Remember we are trading on a 30 minute chart time frame.

On the trading time frame, you look at

- Risk to reward ratio,

- Entry point,

- Stop loss level and the target profit point.

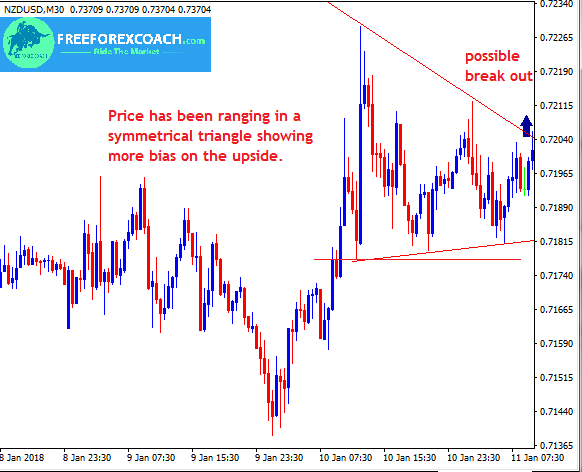

Our trading setup is a break out on a triangle on a 30 minute chart.

Therefore we need a breakout on the upper trend line in the uptrend. we wait for confirmation.

Let’s try to analyse the chart below.

NZDUSD, M30 Chart

From the chart above, the consolidation in the triangle show the battle between the buyers and the sellers.

As price gets more on the upper side of the triangle, it signals that there are more buyers in the market compared to sellers.

This increases more chances for price to break out on the upper side of the triangle signaling a continuation in the uptrend.

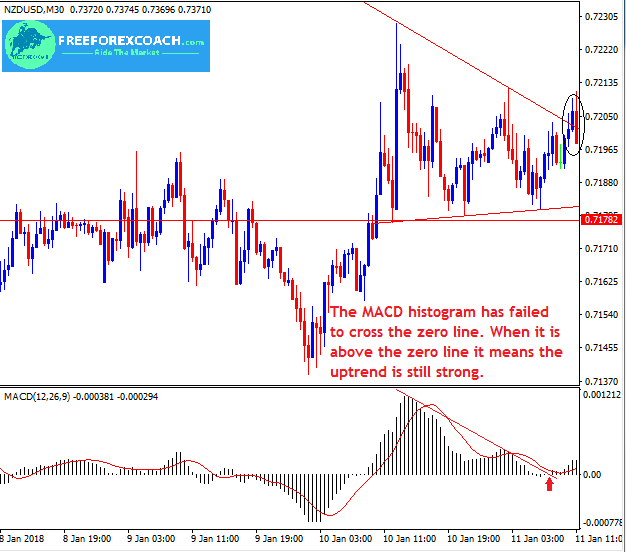

At this point, you can apply your favorite indicator to generate more signal confirmations for our entry before taking a trade.

Using the MACD indicator as extra confirmation,

it shows how the MACD histogram failed to cross over to the downer side below the zero line.

This gives a signal that the uptrend is still strong.Hence calls us to determine our entry point for our trade.

Like we said before, we shall use the lower time frame for pinpointing entry signal.

The Lower time frame – multi time analysis

Let’s take a look at a lower time frame which is the 15 minute chart.

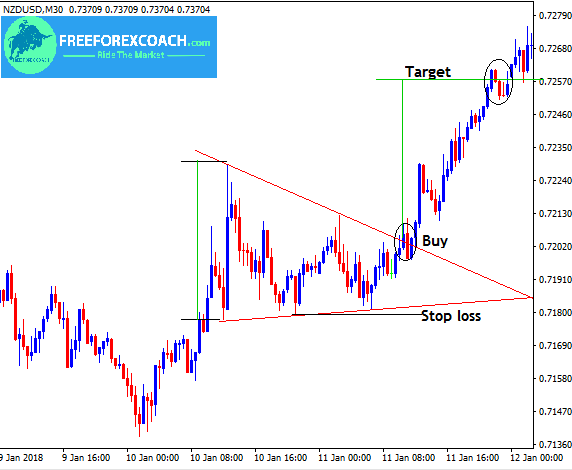

The 15 minute chart has confirmed the break out on the upper trend line of triangle confirming a buy signal.

Since the lower time frame has confirmed the break out, there are higher chances that the trading time frame will also confirm.

We can trigger our entry after confirmation on the 15 minute chart to avoid delays for entry or slippages.

Alternatively 30 minute chart is too huge of candlestick diminishing your reward, you can trigger entry position on 15min Chart as retest.

Trade entry – multi time analysis

Now let’s see what happened after taking a trade.

After taking our trade, price rallied upwards following the predicted trend direction and hit our target without any failure.

When trading with multiple time frame you get a clear picture of what is happening in the market.

More details on how to trade with three time frames in the next lesson.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post