Forex market Liquidity reflects the amount and frequency the asset is traded. It shows how easy it is to buy and sell a currency pair with no major impact on the exchange rate.

The Forex market is extremely liquid because hundreds of banks and millions of individuals trade currencies everyday. In fact, the market size is $5.3 trillion number exchanged daily. It increases as interest by retail traders expands.

The forex market is open 24 hours a day, five days a week, except for holidays.

Currencies are traded worldwide among major financial centers of London, New York, Tokyo, Zurich, Frankfurt, Hong Kong, Singapore, Paris and Sydney.

Unlike the other markets, forex trading does not have to stop when the sun goes down. Since the market is open 24 hours a day, you can trade when it is convenient for you. Also where it is convenient, so where you are does not matter as long as you are online.

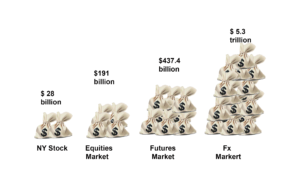

The forex market size

The FX market size is $5.3 trillion daily in trading volume and it dwarfs all the equities and futures markets.

From the illustration above, the market size is incomparable.

In fact, it would take over thirty days of trading on the New York stock exchange to equal one day of Forex trading.

Amazing!

The Forex OTC market is the biggest and most popular financial market in the world. It is traded globally by large number of individuals and organizations.

In the OTC market, traders determine who they want to trade with. This depends on trading conditions, attractiveness of prices and the reputation of the trading counterpart.

Major Currencies Traded on The Fx Market

The most actively traded currencies are: USD 84.9%,EUR 39.1%, JPY 19%, GBP 12.9%, AUD 7.6%, CHF 6.4%, CAD 5.3% and others 25%. Because two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100%.

The US Dollar has the highest percentage in the market.

It offers most of the forex market liquidity. The US Dollar dominates the forex market as the most traded currency taking one half of every major currency pair.

These are some of the reasons why:

- It has the largest economy in the world.

- Is the most stable currency in the world

- Has the most liquid financial markets in the world without forgetting its stable political system.

- From the past centuries during the period of Bretton wood’s, the dollar has always been the medium of exchange for many cross border transactions such as gold, oil and many other products till now.

Forex Market Speculation Vs Forex Market Liquidity.

The forex market is majorly formed by speculators.

These are traders who always look forward to earning money by simply analyzing and predicting the future price movements of currencies.

Speculating traders guess/predict how weak or strong one currency can move against the other to determine which direction to follow.

They depend on their predictions to decide whether to take a sell or a buy.

Trading volumes change due to the participation of different speculators in the market that buy and sell basing on price movements.

The trading volume brought about by speculators is estimated to be more than 90%. This simply means, the level of liquidity is extremely high.

High participation of the speculators lead to a high increase of the amount of selling and buying volumes in the market at a given time. And this, makes it easy for all participants to take on their trades. Whether a buy or sell.

The more liquid the market is, the more participants in the market and increase in volumes of forex trading.

Liquidity Vs Volatility.

Liquidity is very important to investors. It shows how volatile the market’s prices are.

Forex market Liquidity enables huge trading volumes to happen with very little effects on prices.

In other words, higher liquidity usually create less volatile markets. As a result, prices do not fluctuate as drastically as the less liquid markets. thus smaller price movements.

More traders in the forex market, trading at the same time, usually lead to price making small movements up and down.

However, sudden high movements may occur in the forex market due to other fundamental determinants. Such as; social events, economical, political, and environmental factors.

Therefore, traders should always have that in mind to avoid making big losses. We will discuss this factors in the later coaching sessions

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post