To Trade Marubozu candlestick Pattern, you must know it’s qualities, While Spinning Tops indicate Indecision, Marubozu Candlestick Pattern show full control

Funny as it sounds, so is its body.

A marubozu does not have the upper and lower shadows. It is just like a body with no head and limbs. The high and low is equal to the open or close of the session.

Very Interesting! isn’t it?

The Marubozu candlestick pattern has a single candle. It forms anywhere in the trend. It can appear like a long bearish candle or long bullish candle. Therefore, It can either be bearish or bullish.

Take a look at an illustration below

A bullish(Blue) Marubozu candlestick pattern

A blue Marubozu has a long blue body with no shadows. It’s open is equal to low and the close is equal to the high. This simply means that the buyers controlled the market from the beginning to the end of the session.

A blue marubozu is more bullish when it appears in an uptrend giving a strong continuation of the trend.

When a bullish marubozu appears at the bottom of a downtrend, its a signal that the trend is coming to an end. With the formation of another strong bullish candlesticks, expect reversal of the trend on the upward.

On the other hand, if it appears in the middle of an uptrend, it signals a strong trend a head. A morubozu is both a reversal pattern and a continuation pattern.

For instance, a bullish marubozu is a reversal pattern in a downtrend and a continuation pattern in an uptrend.

A Bearish(red) Marubozu candlestick pattern

A bearish Marubozu is a bearish reversal pattern in an uptrend and a continuation pattern in a downtrend. If it appears on an uptrend, there is likelihood of a change in direction.

A red Marubozu has a long red body with no shadows. It forms when the open is equal to the high and the close is equal to the low.

This implies that Sellers controlled the market from the beginning of the session to the end.

If a red(bearish) Marubozu appears in a down trend, it shows continuation of a down trend.

However, if it appears at the top of an uptrend , there is a possibility of a change in direction of the trend.

To use a Marubozu as a signal for entry, you need to wait for confirmation on the candlestick that forms after a Marubozu.

So to trade marubozu candlestick pattern, you must note the position on the trend when it forms.

Let’s take a look at an example below.

How to trade marubozu candlestick pattern on chart

In our chart above, note that after formation of the marubozu pattern,the next red candlestick confirmed continuation of the down trend

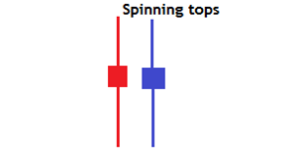

Spinning Top candlestick pattern

The spinning top is a single candlestick with a small body, a long upper shadow and a long lower shadow.

It can form at the peak of an uptrend, the bottom of a downtrend, or in the middle of a trend. The spinning Top reflects indecision in the market which simply means that neither the buyers nor the sellers have control of the market.

The buyers pushed the price up during the period, and the sellers pushed the price down during the period,as a result, price closed very close to the open.

After a strong price advance or decline, spinning tops can signal a potential price reversal. This simply means, the Spinning Top can be either bullish or bearish reversal pattern at the candle close.

A spinning top can have a close above or below the open, but the two prices need to be close together.

Its open is near the close and its long shadows show that both buyers and sellers were active during the market session. Prices moved higher and lower so none of the traders gained.

A spinning top shows the points of indecision between the buyers and the sellers.

Spinning Top in an uptrend/Bearish Spinning Top

From the illustration above, the red spinning top is a bearish reversal pattern. It is more significant when it appears at the top of an uptrend or at resistance.

If a spinning top forms at the top of an uptrend ,it signals that bulls are losing their control over the market. Therefore there is a likelihood of a change in trend.

In case you plan to trade a spinning top after an uptrend it is very important to first wait for a confirmation bearish candlestick before you take a trade.

The formation of a large bearish candlestick after a spinning top gives a confirmation that price is likely to fall for a while.

Though the color of the spinning top candlestick does not matter, the red candlestick is more bearish.

Spinning Top in a downtrend/ Bullish Spinning Top

with reference to the above illustration, the blue spinning top is the bullish reversal pattern. It must appear at the bottom of a downtrend or support to be more relevant.

Further more, a spinning top at the bottom of a downtrend could signal that bears are losing control and bulls may take over.

The formation of a bullish candlestick after a bullish spinning top gives you a confirmation of the reversal.

Besides, the bullish and bearish reversal, If the spinning top occurs within a range, this indicates that indecision is still strong and the range is likely continue for a while.

Though the color of the spinning top candlestick does not matter, the blue candlestick is more bullish.

Quick tips on spinning tops

- The Spinning Top candlestick pattern has a single candle.

- It forms at the top of an uptrend, the bottom of a downtrend, or in the middle of a trend. It can be a bearish or bullish candle.

- if a blue spinning top forms on a resistance level, it should be considered a potential bearish signal even thought it is bullish.

- Similarly, if a red spinning top form on a support level, it should be considered a potential bullish signal even though it is bearish (red).

- In this case the confirmation candle is very important before you make any decisions to buy at support or sell at resistance.

- Remember, the color of the spinning top candlestick does not matter. However, a red spinning top is more bearish and a blue spinning top is more bullish.

quick tips on marubozu candlestick pattern

- If a red Marubozu occurs at the end of an uptrend, a trend is likely to reverse. However in a downtrend, its a continuation.

- If a blue Marubozu occurs at the end of a downtrend, a trend is likely to reverse. But in an uptrend, its a continuation.

Lastly, do not always rush to take trade when you spot a spinning top or a marubozu.

Like any other setup to trade, always wait for the confirmation candlestick to complete.

It will save you a lot.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post