Trading News in Forex Summary is an overview of what we covered in previous lessons.

Traders normally depend on news report release to anticipate what’s likely to happen in the market because it’s the news that moves market.

Trading news is good for traders who like seeing profits within a shortest period of time.

During news release, price changes are quick and so fast and it’s this time when you see the longest candlestick movements in the market.

It is during this period that some traders exit their trades or tighten their stops. Other traders prepare to take advantage of the strong moves in the market.

Which news can I trade?

News release from the USA always affects the market because it has the largest Forex market economy and most pairs depend on the US dollar.

The US dollar is the world’s reserve currency therefore any changes in the U.S. economy shakes the Forex market and causes a lot of volatility.

You should also look at the news that comes from the major financial economies in the Forex market.

These include news release from USA, the Euro zone, Canada, Australia, UK , Switzerland, Japan, Germany and China.

Major news reports are;

- Interest rates

- Non-Farm payrolls (NFP)

- FOMC

- Consumer Price index (CPI)

- Employment and unemployment rates

- Gross Domestic Product (GDP)

- Trade balances

- Crude oil inventories and

- Purchasing Manager Index (PMI).

Where can I find news data?

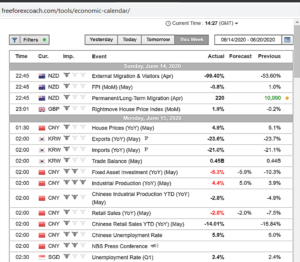

Major fundamental news is released every day of every month as scheduled on the economic calendar.

It is usually scheduled monthly or quarterly. It is advisable to always check for news that is likely to affect the market before you start your trading day.

You can easily access the economic calendar online as long as you have internet.

The economic calendar shows, the news category and the degree of volatility.

It also has provision for the previous data, forecasted data and the actual news data release .

This provides a basis for comparisons to gauge the performance of the country’s economy before taking any position.

Forecasted data: this is the estimate data before the actual news release.

Actual figure: the real news release from the source at the present date

Deviation: the difference between the actual release figure and the forecasted figure.

When the actual news is better than expected, The currency will appreciate and the Forex market will become more bullish.

On the other hand, if the actual news release is less than expected, the Forex market will become more bearish.

Trading news in forex summary on how to trade news releases

3 ways you can trade news

Place a trade before the news release. That is within 10-20 minutes to the time of news.

Analyze the market before the news release comparing both the technical and market sentiment.

Take position if both are in agreement.

Or you can trade news at least 5 min after the news release.

In this case, you enter a position after the news release.

After doing your market analysis, wait until the news is released. Then you open a position.

You can also trade news before and after news release

Here you add more positions after news release by scaling.

Trading news in forex is so challenging and it is the time when the market is very volatile.

You are either in or out.

When your prediction is wrong, you get kicked out immediately either with a small loss or a big draw down on your account.

During high volatile news release,you may face increase in Spreads .

Also Slippages are likely to occur due to high volatility hence delays in execution of some of the orders and sometimes closing with a bigger stop loss than expected.

Therefore, you need to trade with caution and use stop loss to limit your loss in case your prediction goes wrong.

Take your time and understand how different economic fundamentals affect different country’s currencies before you jump into conclusions.

It is very tricky to trade news but when mastered it is one of the surest ways to earn large profits within a short time.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post