Most Volatile Currency pairs in Forex market tend to increase or decrease faster in value. They form very large candles or pin bar within a shortest time.

The quick and slow movement of prices in the market is caused by volatility.

First, let’s look at what Volatility is before we learn the most volatile currency pairs in Forex!

What is volatility?

Volatility (in Forex trading) refers to the impact unpredictable changes in a currency exchange rate over time of a certain currency pair is likely to bring to the currency market.

It reflects the degree of risk faced by someone with exposure to that currency pair.

With high volatility, the price of a currency pair fluctuates rapidly in a short time. This can be identified by large price candlesticks or long pin bars in the market.

On the other hand, If the price of a security fluctuates slowly for a longer time, it is referred to have low volatility.

In periods of high volatility, spreads are likely to increase, traders are likely to face slippages and at times price tends to gap.

Let’s now look at least and most volatile currency pairs in Forex

Examples of most volatile currency pairs in forex.

As said earlier most volatile Currency pairs in Forex tend to increase or decrease faster in value. They form very large candles or pin bar within a shortest time possible.

These currency pairs are highly profitable but very risky to trade.

Some of the examples include; GBP/JPY, GBP/AUD, GBP/CAD, EUR/NZD and GOLD.

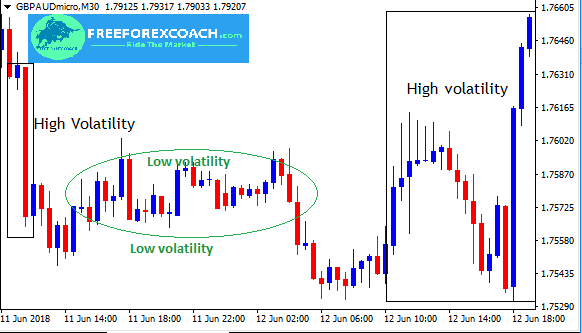

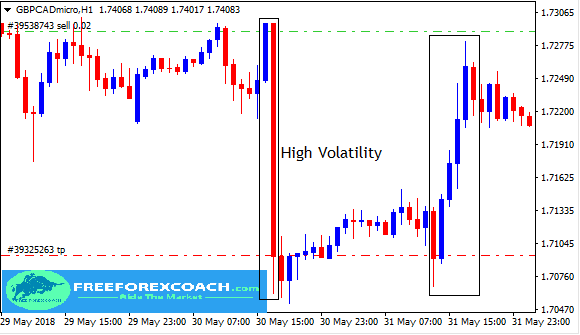

Let’s take a good look on GBP/AUD, 30 Min chart and GBP/CAD H1 chart showing high Volatility in the market

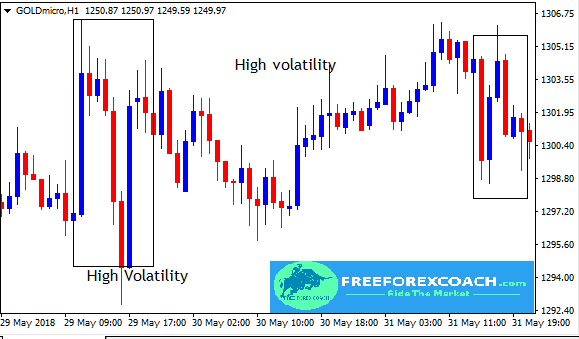

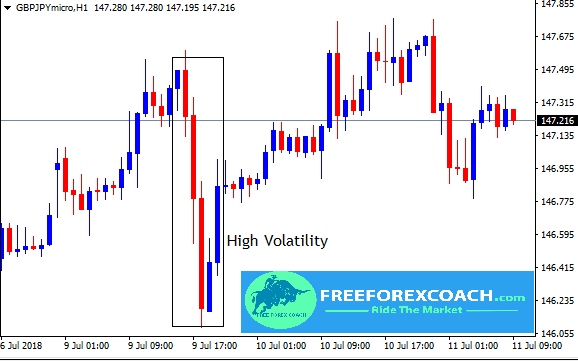

Charts below show periods of high volatility as seen on GOLD H1-chart an GBP/JPY H1-chart

Examples of less volatile currency pairs in forex

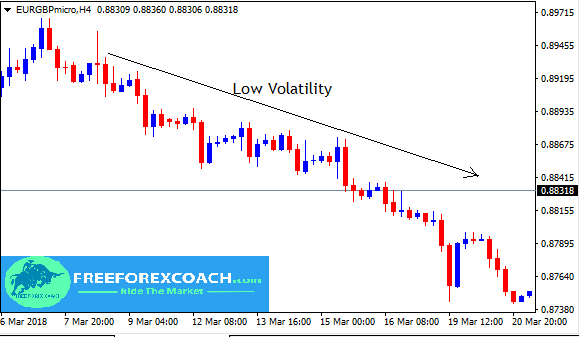

Less volatile currency pairs tend to move slowly and quietly for long. At times they seem not to move at all.

They form small candlesticks in a range form of movement. Some of the examples are EUR/CHF, EUR/GBP

Lets take a look at some examples of least volatile pairs in Forex below.

Low Volatility on EUR/CHF Daily chart and EUR/GBP H4-chart

Why is currency volatility important to a trader?

Volatility measures the level of risk a trader is likely to face in the market.

A market with no or slow volatility has never been attractive to a trader.

It is not easy to profit from a slow-moving market especially for the day traders since they realize their profits and close their trades at the end of the day.

It is the higher volatility that usually makes Forex trading more attractive to the market players.

Risk Involved

Volatility helps you to know the risk involved in trading a particular currency pair.

This gives you a clear picture on how to choose an appropriate size for your trading position basing on how much risk you can tolerate.

It is appropriate to always use a small size when trading high volatile currency pairs and large size when trading less volatile pairs.

Since volatility describes how much a price is likely to move over a certain period of time, by doing this you are able to reduce the impact of volatility on your trades.

Short-term trader and Position trader

Understanding currency volatility also helps you to choose the market that matches your trading style.

For instance, you wouldn’t be a day trader and you choose to trade in a slow-moving market (less volatile market). Or a position trader and choose to trade in a high volatile market.

Your trades are likely to close-out pre-maturely or may not have enough capital to hold on a trade for long.

Highly volatile pairs have large spreads so once a trade goes against your direction you lose a lot.

For short term traders (day traders), it is appropriate to choose high volatile pairs to trade. Larger price movements bring more and quick potential profit.

As you close out one trade, you take on another opportunity. Just in a single day, you are able to achieve your targets and realize profits on different trades.

It is a habit to most traders that they prefer to trade in most volatile market due to the fact that the markets are attractive and yield profits quickly.

The fact is, it is all true.

Once you take a position and with just one candlestick your target profit is hit, that is every traders dream. However, this has also got its negative side.

We tend not to see the other side of this coin: Higher volatile market conditions are very hard to predict.

If you get on the wrong side of the market, the potential loss can be higher due to the large price movement. As a result of large price fluctuations, reversals can be more aggressive.

How do you measure volatility in the market?

You can measure volatility by using volatility indicators as designed by J. Welles Wilder for that purpose.

These indicators are provided on the MT4 platform and are easy to use.

Volatility indicators include, Average True Range (ATR), Bollinger bands and moving average.

Volatility Vs Liquidity

As we mentioned earlier, volatility refers to how much a price moves over a certain period of time.

Liquidity refers to how active a market is. The easiness of buying and selling currency pairs without affecting the price.

A market’s liquidity has a big influence on how volatile the market’s prices are.

Lower liquidity usually results in a more volatile market and cause prices to fluctuate more rapidly.

Higher liquidity usually creates a less volatile market and prices don’t fluctuate largely.

Prices move more smoothly in a more liquid market and make more random large movements in a less liquid market.

Nevertheless, you don’t have to worry about liquidity as a trader. The forex market is the most liquid market having about $5.3 trillion daily in trading volume.

Because more traders are always in the market at the same time, price usually makes small movements up and down.

However, drastic and sudden movements are also possible and can happen in the forex market.

How Liquidity affects Currency Volatility in the Forex Market

Since currencies are affected by political, economic, and social events, there are many occurrences that cause prices to become more volatile.

One of the reasons is, during the release of most important news events.

Because most traders avoid to trade during news release, avoiding high risks, this creates less liquid in the market.

Also, the absence of some liquidity providers on the market trying to avoid risk.

As a result, the market becomes more vulnerable to unexpected and highly volatile price movements.

News or rumours is the number one catalyst which often leads to a spike in price movements and gaps. Very sharp movements often happen into both sides.

The market is also less Liquid during important public holidays.

It is always extremely difficult to predict the price movements in periods of high volatility and the market risk is also high.

As a trader, you must always prepare for the unexpected increase in volatility, if you have open positions.

You should always be mindful of the current events. Keep updated on financial news on the economic calendar, to avoid potential loss.

Conclusion on most volatile currency pairs in forex

For many traders, especially new traders, are always attracted to higher volatile markets, which exposes them to significantly more risk than benefit.

This is because, they want to make quick profits, therefore want to take every chance that surfaces without thinking twice.

As traders, price movements are your sources of profit.

Larger price variations mean more and quick potential profits. But is this not always the case.

So, before you go into running for large price movement situation profits, please know that risk management is a necessity when trading in these higher-volatility environments.

Your greed for large profits should not blind you. I guarantee you, anything can happen in the market.

And once you have failed to observe that, the risks of trading in a highly volatile environment can be a quick way to face a dreaded margin call or blow down your account.