Evening and Morning Star Candlestick Patterns are defined as 3 candlestick patterns.

The three candlestick patterns are composed of three candlesticks each representing the behavior of traders in the market in a certain period of time.

Some of the patterns are;

- Morning star

- Evening star

- Three white soldiers and

- Black crows

- Three inside up & down candlesticks.

The Evening and Morning Star candlestick patterns.

These are 3 candlestick patterns, two large candlesticks with a small body candlestick between them. They normally appear at the end of the trend.

Morning Star Candlestick Pattern

The morning star is a three candlestick pattern that normally forms at the end of a down trend. It is a bullish reversal pattern.

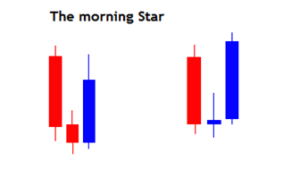

Let’s first take a look at its structure below.

From the illustration above, we can clearly see;

- The first candlestick is bearish (Red).

- Second has a small body(Red). This showing indecision in the market.

- The third is larger than the second and bullish(Blue).

In addition to that, the second candlestick does not matter whether bullish or bearish. However, it is more significant when bullish.

The third candlestick should close above half way of the first candlestick showing that the buyers are gaining control.

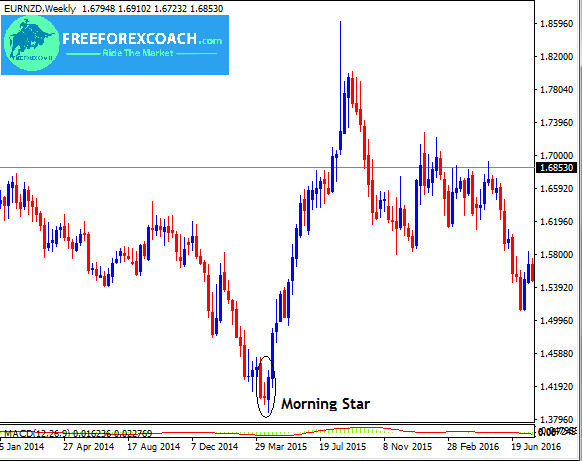

Identify the Morning star on the chart below.

When you look at the above chart,

You can tell that a morning star is really a bullish reversal pattern or a bottom reversal.

It is the third candlestick that gives confirmation in the pattern.

Therefore, if you were to trade this pattern, you would enter after the close of the third candlestick.

It is also very important to note that,the morning star is a strong reversal pattern.

Evening Star candlestick pattern

The evening star candlestick is a bearish reversal pattern. It forms at the end of an uptrend signifying the possibility of a bearish reversal.

The three candlestick pattern comprises of two large candlesticks and a small candlestick in the middle top.

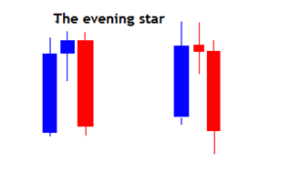

Let’s see how an evening star looks like.

The first candlestick is bullish(Blue) and is the same as the previous trend.

Second has a small body indicating indecision in the market.

The third is bearish(Red) which closes below half way of the first candlestick.

This gives a signal to traders showing how the bears/sellers have gained control of the market.

It is the third candlestick that gives the confirmation of the possible change in the market trend.

The evening star is a strong bearish reversal pattern especially when at resistance.

As a trader, you should give it your attention especially when in a long trade. It is a good signal for you to close the trade.

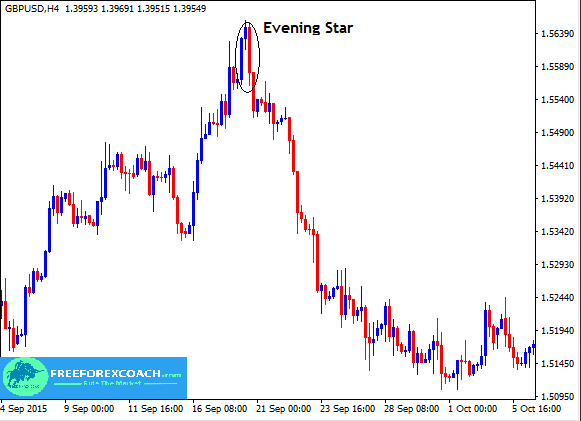

Evening star reversal pattern on a candlestick chart.

From the above chart, we can all identify the evening pattern as indicated in a circle.

The appearance of a small candlestick after the first large bullish candle signify that buyers are losing control. Therefore cannot push the prices higher.

When the third large bearish candlestick forms, it shows that sellers have now taken over the market giving us a confirmation entry for a sell signal.

Evening and Morning star candlestick patterns are the commonest to traders. Lets look at other types of 3 candlestick patterns.

Three Soldiers and Three Crows

Three soldiers and three crows are 3 candlestick patterns composed of 3 large candlesticks. They can appear both in an uptrend and a downtrend.

These are also continuation patterns.

Three Soldier candlestick pattern

The three soldiers candlestick are3 large bullish candlesticks.

They normally appear after a long fall of prices indicating a probable reversal in trend. It is a bullish reversal pattern.

However they are also a continuation pattern when in an uptrend.

This pattern is more bullish when it forms after an extended down trend or after a congestion.

The second candlestick should be bigger than the first candlestick and slightly smaller or same size as the third candlestick.

This shows great power and full control of the buyers in the market. The three candlesticks have small or nor upper wicks/upper shadows. Prices close near the high.

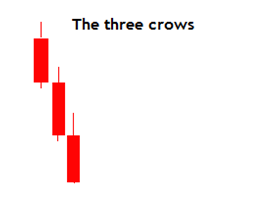

The three crows

These are the triple bearish candlesticks that appear after a long upper trend indicating a reversal in trend. Three crows is a bearish reversal candlestick pattern.

They can also signal a strong continuation in price fall when in a downtrend.

Below is the three crows candlestick pattern.

Like the three soldiers, the second candlestick of crows should be larger than the first and slightly smaller or equal to the third candlestick.

This indicates a big shift of power from the buyers to the sellers. The candlesticks have small or no wicks/lower shadows, prices close near the low.

Taking a look at the above chart, the 3 soldiers and the black crows are identified with the circles.

The three black crows are bearish reversal pattern when at the top of a trend.

However, It always signifies a strong trend a head when it appears in the middle of a downtrend.

The three soldiers are bullish reversal patterns when at the end of a downtrend. It also signifies a strong uptrend when in the middle of an uptrend.

Three inside up and down

These are three candlestick patterns are two large candlesticks with a small candlestick at the middle top or bottom.

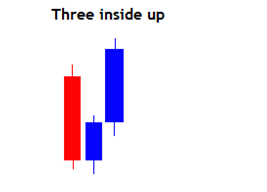

Three Inside Up

The three inside up forms after a long fall of price indicating a probable bullish reversal. It is more of a morning star candlestick pattern

The first candlestick is a long bearish candlestick in a downtrend.

The second is bullish and should close halfway the first candlestick.

The third candlestick is a large bullish candlestick.

It should close above the open of the first candlestick and above the high of the second candlestick.

The third candlestick gives a confirmation that the buyers have already taken control of the market with strong power to reverse the trend.

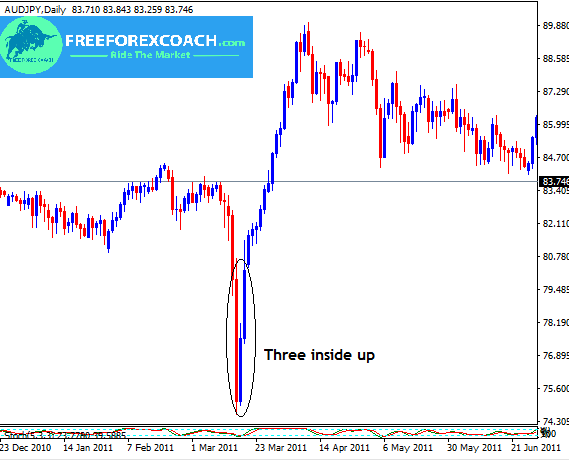

Three inside up is shown on the chart below. Let’s see how it appears.

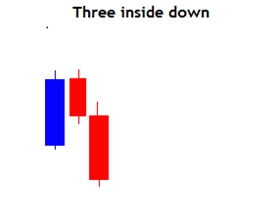

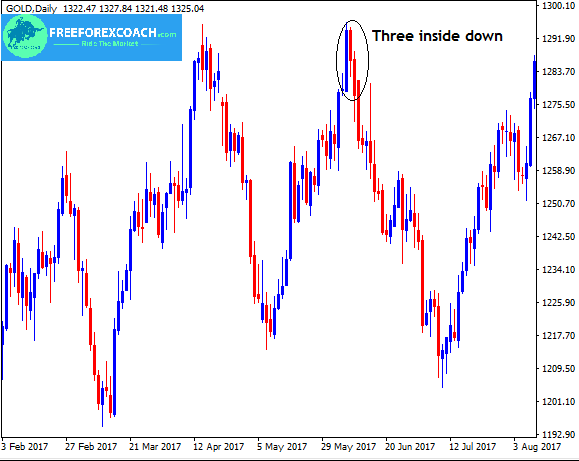

Three Inside Down

The three inside down is the opposite of the three inside up.

This is almost similar to the evening star candlestick pattern. It is a bearish reversal pattern with a combination of three candlestick.

The first candlestick is a large bullish candlestick as the previous uptrend.

Second is bearish and it closes half way the first candlestick .

The third candlestick is bearish. It should close beyond the open of the first candlestick and below the close of the second candlestick.

This gives a confirmation that the sellers have full power and control of the market therefore a reversal is likely to happen.

The chart below shows the three inside down pattern.

It is always important to take note of these different candlestick patterns whenever they appear on the market charts. This is because they have a great impact on the market sentiments.

Evening and morning star candlestick patterns are the commonest of all the 3 candlestick types.

Whoooooo.! it has been a lecture!

To some of us who are not good at keeping up the pace with a lot of notes, don’t worry at all.

Follow the summary in the table below. It contains all the important candlestick patterns. We have put them in groups according to their names, numbers, behavior and shapes.

Take a look!

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post