The forex market is a decentralized global market where all the world currencies are traded. Among the currencies there are majors, crosses and the exotic currencies.

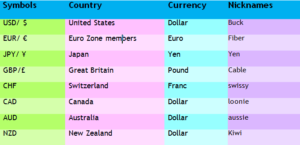

There are more than 100 different official currencies in the world and the major currencies include as shown below with their respective countries and symbols and nicknames.

As you can see from the table above, currency symbols have three letters, where the first two letters identify the name of the country and the third letter identifies the name of the currency.

The currencies above are called ‘majors’ because they are most liquid and widely traded. The most commonly traded currency pair is the Euro Vs U.S. dollar, followed by the U.S dollar vs the Japanese Yen and GB pound Vs the U.S dollar.

Currency pairs that do not include the U.S. dollar are referred to as cross currencies; the most commonly are the Euro Vs the Yen or British pound.

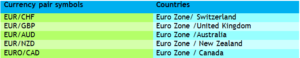

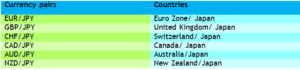

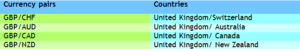

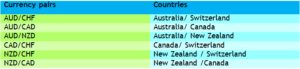

Major crosses are also known as minors, i.e. The most traded crosses and are derived from the three major apart from USD currencies. They are, EUR, JPY, GBP

EUR crosses,

YEN crosses

Pound crosses

Other crosses

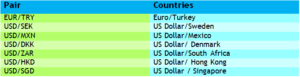

Exotic pairs

Exotic Currency pairs are made up of major currency paired with the currency of the emerging or a strong but smaller economy from a global perspective such as Hong Kong, Singapore and European countries out of Euro Zone.

These pairs are not traded as often as the majors or minors, the cost of trading these pairs can be higher than the majors or minors due to the lack of liquidity in these markets, low trade volumes and large spreads.

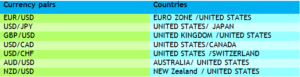

Major Currency pairs

These all contain the US Dollar on one side, either the base side or the quote side. They are the most frequently traded pairs in the forex market because they have the lowest spread and are the most liquid.

The EUR/USD is the most traded pair with a daily trade volume of nearly 30% of the entire forex market

When placing a trade, you are speculating on which currency you believe will become stronger or weaker against the other and the motive is to make a profit from the exchange rate movement. The currency to the left is the called the base currency and to the right is the quote currency.

The quote currency tells us how much it is worth against one unit of the base currency. If we say the EUR/USD, is trading at 1.3000, it means 1 Euro equals $1.30.

The base currency is the basis for the buy or sell trade. If we believe that the Euro will strengthen against the dollar, we would buy the EURUSD pair which means we are buying the base currency Euro and simultaneously selling the quote currency the US Dollar. If we believe that the Euro will weaken against the US Dollar, we will sell the pair; we are selling the Euro simultaneously buying the US Dollar

The buying and selling of currency pairs is done on over the counter market. The buyer and the seller are linked together by the broker or the dealer. There is no physical contact between the buyer and the seller.

Over the counter( OTC) refers to trade being done through a dealer network. E.g. if you buy medicine from a shop without going to a doctor for prescriptions that is an example of buying over the counter market. Currencies are traded directly between two parties electronically through a broker, no physical location.

It is the world’s most traded market with an average turnover in excess of U.S.Dollar 5.3 trillions per day with New York stock exchange (NYSE) market being the largest stock market in the world with a trade volume of about $22.6 billion each day but only a fraction of what forex trades.