You would be suprised at reasons why most Forex Traders fail to Make Money from Trading. They are simple reasons mostly emotional.

Out of 100, only 5% of the traders have managed to make CONSISTENT profits and the 95% have failed. Out of 95%, 99% are the new traders.

Well, the truth is, even the 5% of the successful traders were once new traders. They also passed through the same experience.

The difference here is that they were able to overcome this kind of dilemma.

They understood what they needed to do to become successful and consistent traders.

To be honest I have also gone through the same things.

I have made all sorts of mistakes not more than once or twice but on several occasions.

Like they always say, experience is the best teacher. You have to wake up and learn from your mistakes.

Every trader has his or her own weaknesses when it comes to trading.

Let’s look at some of the common reasons most Forex traders fail to make money from trading!

Trading with consistency is key. What is the cause of failures?

Why do most Forex Traders fail

1. Very high expectations.

Yes! Most traders approach the markets with extremely very big hopes thinking all is put on the silver plate. They think as long as you know when to enter a trade, you have made money already.

As a new trader, all you care about is a blue color on your statement but you don’t know how you will maintain that.

When the market goes against you and your profit turns to red, you immediately close the trade because you are scared to lose.

In case you had no stop loss and the loss is already big, you would rather wait till the market moves back to your direction.

You don’t want to lose a single cent/dollar from your account. Trust me, with this kind of behavior, there is no way you will see consistent profits on your account.

This happens because you start trading expecting to make lots of money from the market.

You didn’t consider the other side of trading, losing. This goes against the psychology that is required for successful trading.

As a result, your account always suffers big draw downs.

How do you overcome this?

Forex trading always has two outcomes. It is either a win or a fail. Not understanding this is what makes most forex traders fail to make money from markets.

You may have a system or strategy that has a 70% success rate and 30% accepted loss rate. Well tested several times and approved.

However if you focus on winning only, and not on doing the right thing, you may not last for long.

Wanting to win so badly is always accompanied by psychological emotions such as fear , greed and regret. This is likely to cause a direct conflict with your trading process.

Before you even think about trading, there are some things you need to know.

- When you take a position in the market, always bear this in mind; anything can happen. You always expect a win or a loss.

- However much your strategy may perform, it can never be 100% perfect.

- Risk only the money you can afford to lose and keep risk management strategies in intact to keep your losses smaller and protect your account.

2. They don’t want to learn first.

Like we said before, most new traders are driven by a money motive to the market.

Telling such a trader to spend more time learning and practicing is wastage of time.

Most new Forex traders take Forex trading to be simple. All they look at is having a trading strategy that shows when to buy and sell.

Forex trading is not as simple as it sounds;

BUY when the market is going up and SELL when the market is going down. That is not it all. Like any other profession, you need to learn first.

Train and practice consistently to be able to have consistent profits to your account.

Why you need consistent learning and practice?

Consistently learning and educating yourself helps you to develop trading skills and unveils most of your common mistakes.

Read and understand the basics of Forex and practice more on a demo account.

This will turn you into a more knowledgeable person, with enough experience.

The Forex information is available everywhere online.

All you need is internet and you acquire every detail of information that will help you to study the market behavior.

More to that, you can get yourself a mentor to always guide you. Read more books, browse through forums and sign up for trading courses to acquire more knowledge.

Most important of all, do more practice on a demo account. Do not get tired of practicing till you learn the right way to hold the hook.

3. Always excited to trade news events.

At the release of most fundamental data, the market makes the very strongest and large price movements.

Economic fundamental news highly affects currency prices in the market. Prices move strongly especially when the news is in extremity of more than expected or less than expected.

This simply means if you trade right with the actual news release, you are likely to make big sums of money just in a few minutes.

If this is possible, then there is also a possibility that you can blow your account the same way and you end your trading career.

Most forex traders fail to make money because they are so eager to trade news without preparing enough. They get too greedy to catch the large price movements in the market.

Trading news with no preparation can actually stab your back especially when you trade with no stop loss .

In the end, you will lose all your hard worked money to the market.

Never the less, it is not too late to turn things around.

If you want to trade and achieve consistent profits, have a plan and trade only your plan.

This means even when you are to trade news; you will follow the same risk management strategy and protect your account from large losses.

It is very important to know that when you trade news, you are either right or wrong. Therefore, never trade with out a stop loss.

4. They don’t have a specific strategy to trade.

Forex trading information is available and easy to access online. Courtesy of free learning websites, trading signals and robots.

All these offer different trading strategies to trade and trust me they are all awesome.

Most new traders always get excited with these fascinating trading strategies every time they read about them. Always thinking there is a holy grail out there.

It is exciting every time you try out one and you take a profit on your first trial.

I fell for it too. Very lost and confused as I tried to learn different trading strategies, thinking it would make me a better trader and make for me more profits.

I would try out a new trading strategy and make some money at the start. But when i would lose twice; I would drop it and pick up the next one or trade all at the same time.

At the end of the day, I am closing with a very big draw down and I am thinking of looking for a better one.

This is so frustrating and does not do you good as a trader.

All you are doing is experimenting or gambling not trading. It is not hard to find a trading strategy.

However, finding a trading strategy that has an edge in the markets and suits your personality, is a different thing altogether.

Trading different strategies at the same time where you have no control over them, won’t do you good. Rather it suck up all your money from your account.

Here is the good news;

If you plan to see consistent profits from trading, find a trading strategy that has an edge in the markets, and suits your personality.

Study and practice only that and trade only that.

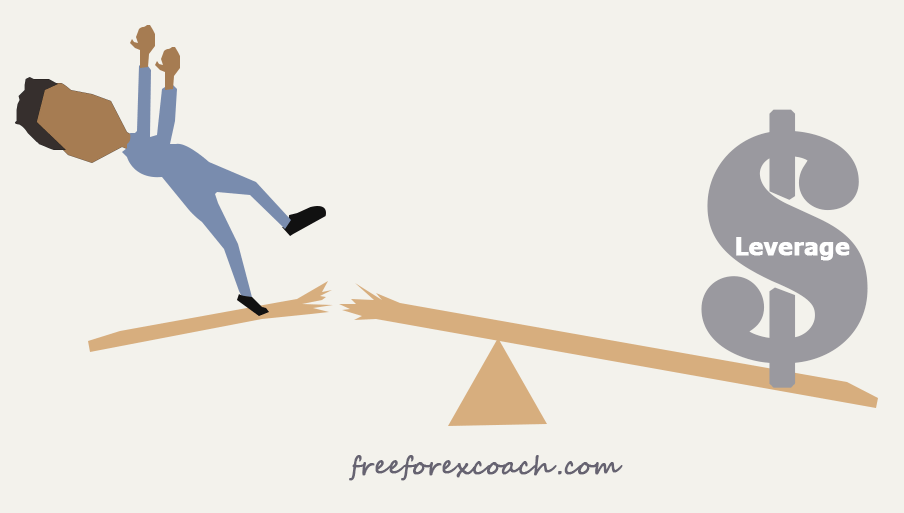

5. Poor risk management

You can have the best trading strategy in the world, but poor risk management can still cause large draw downs to your account.

There are so many times we get to the market only thinking on how far the trade may go, and how much money we are likely to make after taking profit.

This is another reason why most forex traders fail to make money from trading.

The greater the potential reward, the greater the amount of risk the trader must take on.

Of course you will be forced to use a large size because you expect to get much reward from your set up.

After all you are well convinced that the trade will take your favored direction. This is a very common practice to the new traders.

Common challenges most new traders face trading forex.

As a new trader, you take a short term trade and watch price move in your favor.

Immediately, you get excited and confident then feel like you are in control of the market.

A few pips to your target profit, you notice your trade starting to go against you.

What next, your stop loss? You are now in the red.

With panic, you cancel your stop loss.

You believe it is a matter of time before the market turns to your favor once more. So you hold on to that believe, but it continues to move further against you.

So now you no longer think about your target profits. You silently pray for a break even to close out your trade.

Unfortunately price just takes off as if it was a payback time and the loss is unbearable. What next?

Regrets.

Regardless of the setup or trade signal you are trading, all trade opportunities are equal and the outcome is random.

So in order to avoid regrets due to large losses, we must follow our risk management rules.

Always consider how much you are willing to lose on each trade, your risk to reward ratio and use a stop loss that matches your size at all times.

6. They don’t have a trading plan.

A trading plan contains guidelines and procedures for you to trade in the right direction.

It explains;

- Your trading strategy

- Entry and exit level

- Risk management

- Markets traded

- Time frame to trade on

- And position sizing.

Attempting to trade the Forex market without a trading plan is one of reasons why most traders fail to make money.

Yet it’s one of the most common mistakes Forex beginners make.

It leads to trading basing on psychological feelings and emotions or gambling. When you have no trading plan, you trade aimlessly and have no idea which area of your trading needs improvement.

Your trading plan should articulate your risk management strategies. Why you would enter a trade? how you will manage that trade, and why you would exit that trade?

Your plan should also include detailed and accurate record keeping of your trading journal .

A trading journal will help you keep track of your system’s trade expectancy. Common mistakes made while trading and decisions taken before, during and after taking a trade.

Conclusion.

Finally, i conclude by saying, depending on only your trading strategy is not enough to make you a successful trader.

If you want to have consistent profits from trading Forex, you have to unlearn the habits we have discussed above and start training yourself in the right direction.

The most interesting thing when it comes to Forex trading, is that you can learn and profit from the experience of others.

If you can manage to reduce the number of trading mistakes, then you will be a step closer to consistent profitability.