Currency Pairs Correlated in Forex are quite easy to sport on the Forex Market charts.

As a Forex trader, it’s very important to monitor currency correlation as this may affect your trading without you even knowing it.

When you realize that you lose on trades every time you hold more than one trade, all at once, check the correlations. Your trades may also seem to offset each other, as one profits the other loses.

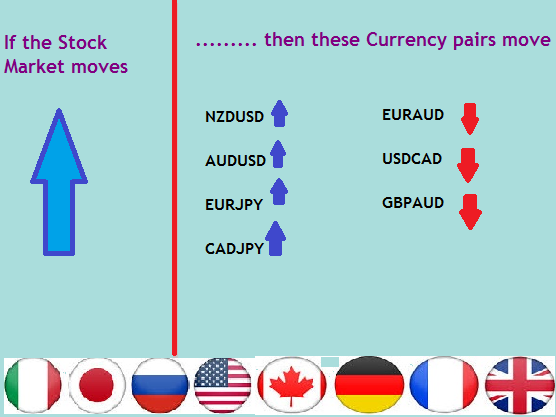

Being aware of currency correlation helps you control risk, find alternative trading strategies and alert you to potential dangers or opportunities.

For example it helps you to know the trend direction and confirm trend signals by comparing currency pairs.

But before we talk about currency pairs correlated, let’s first know what currency correlation is.

What is currency Correlation?

Currency correlation simply means, how one currency pair moves in relation to another.

Some pairs move in same direction. Others move in opposite directions while other pairs may have no relationship at all.

The correlation coefficient ranges between -1or (-100) and +1 or (+100). The number between -100 and +100 shows the strength of the relationship.

A correlation of -100 or (-1), means the two currency pairs will move in the opposite direction 100% of the time. (Negative Correlation)

When it is +100 or (+1), means that the two currency pairs will move in the same direction 100% of the time.(Positive Correlation)

A zero correlation implies that the relationship between the currency pairs is completely random.

Let’s now look at examples of currency pairs correlated in the Forex Market.

Examples of currency pairs correlated positively

EUR/USD and GBP/USD, EUR/USD and NZD/USD, USD/CHF and USD/JPY, AUD/USD and EUR/USD, USD/CAD and USD/CHF, EUR/JPY, AUD/JPY, GBPJPY AUD/JPY AND NZD/JPY, EUR/USD, EUR/CAD, EUR/JPY AND EUR/GBP.

Following the above examples, you will realise that there is always something in common that connects them.

Let’s call it a common factor.

They are either sharing a base currency or a quote currency. Just take a good look.

Significance

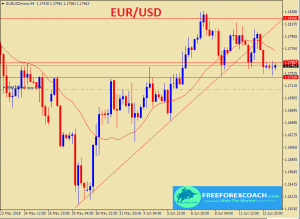

If the price of the EUR/USD increases, this means that either the EUR is in more demand or the US dollar is in less demand.

If there is less demand for the US dollar, then all currency pairs quoted with the dollar as the second currency will rise.

This is because the fall in demand for the US. dollar affects the global forex economy at large.

In that case, you will see GBP/USD, AUD/USD and NZD/USD also increase. If there is a less demand for the EUR, then EUR/USD will fall as well as all currency pairs with the EUR as the base currency in the pair.

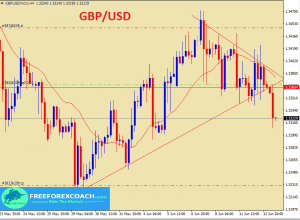

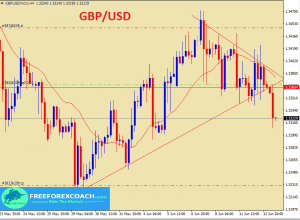

Two charts below illustrate the positive correlation between the EUR/USD and GBP/USD

Examples of currency pairs correlated negatively

EUR/USD and USD/JPY, GBP/USD and USD/CHF, USD/CAD and NZD/USD, USD/CHF and AUD/USD, CAD/JPY and AUD/CAD, CAD/CHF and CHF/JPY.

For currency pairs correlated negatively, the common factor (currency) is in different positions in the currency pairs.

In one pair, it is a base currency. In the other, it is a quote currency.

Let’s choose among the above examples; GBP/USD and USD/CHF. The US. dollar is the common currency in both pairs. It is a quote currency in the first pair and a base currency in the second pair.

Significance

Unlike for positive correlated currency pairs, when currency pairs are negatively correlated, as one currency pair rises, the other falls.

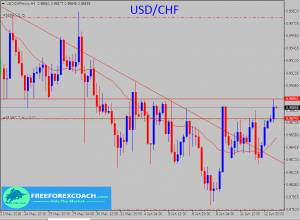

If we can take a good look at GBP/USD and USD/CHF H4 chart below.

If the demand for the dollar decreases, then the price of the GBP/USD will rise, whereas the USD/CHF will fall. The reverse is true.

This is because the USD is in different positions for the two currency pairs.

From the above chart, as GBP/USD rose, the USD/CHF fell as identified by the red trend line. This shows two pairs moving in different directions.

The break of the trend lines shows change in direction for both pairs.

The two currency pairs always move in the opposite directions because of their negative correlation.

Currency pairs which highly positively correlated tend to move in the same price direction 100%. And pairs that are negatively correlated tend to move in the opposite direction 100%.

Knowing which pairs move opposite and which move together is very vital especially when trading multiple currency pairs.

Importance of currency correlation to a trader

1. Increase in the overall risk to your trading account

It is every trader’s goal is to always minimise losses and maximise profits.

Currency correlation can affect the exposure and risk to your trading account.

As a forex trader, it is important to understand the relationship between currency pairs. This helps you to know your risk exposure so that you are able to control your losses

Let’s say that you risk 2% of a trading account on a single trade.

If you open a long position on both the EUR/USD and the GBP/USD, then, this means that you have two trades with a 2% risk on each.

Because of a positive correlation between the EUR/USD and GBP/USD, if one currency pair moves against your trade, the other will too. Your risk doubles to 4%.

Understanding currency correlation helps you to avoid exposing your account to a great risk.

2. Taking positions that can cancel each other out

If you open up a long position on the EUR/USD and a short position on the GBP/USD, because the two move in the same direction, one is likely to profit and the other fail.

Any profit made on one trade is offset by the loss on the other.

Similarly, if you open the same position on a negatively correlating pair, such as going long on the EUR/USD and the USD/JPY, as one profits the other loses.

In the same way, the profit made on one trade is offset by the loss on the other.

If you take currency correlation in consideration before opening positions, you are a step a head to avoid unnecessary losses on spreads and making little or no profits.

It also helps you to choose the correct pairs to trade with ease without having to watch your trades all the time.

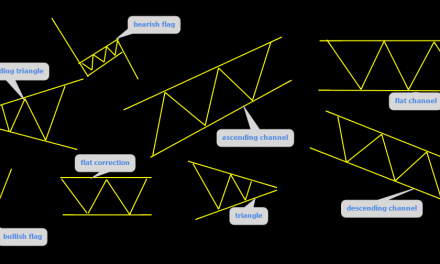

3. Trend confirmation and generating signals

You can use currency correlation to confirm the trend direction of the pair you are currently watching.

All you do is to check whether the positively correlated pairs are moving together with the currency pair that you intend to trade.

So, if the currency pair you intend to trade moves down, you can use other currency pairs that positively correlate to see if they are also moving down to confirm your analysis.

More to that, you can also use correlation to generate signals to trade on the currency pair you intend to trade.

If the currency pair in question is ranging and you expect a breakout to the upside, you can use positively correlating pairs to see if the breakout is on the upside to confirm your trade signal.

Conclusion on currency pairs correlated in forex

If you take multiple positions when trading, knowing how your pairs act in relation to one another is key to understanding your real risk and profit potential.

This helps you to know what is likely to happen in case your trades fail or profit.

However, basing on currency correlation to trade is not 100% perfect.

Like any other strategy, correlation has its own pot-holes.

The truth is, it can change sometimes.

But the good news is this happens only for a short time and the currency pairs get back together. Be aware and expect anything in the market.