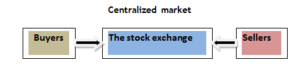

The forex market structure is quite different from other market structures. Compared to the stock market, forex market structure is decentralized. But the stock market is a centrally controlled market structure.

Let’s have a look at how the stock market structure stands.

The stock market structure is a monopolistic central exchange structure where only one entity controls prices.

Some of the examples are;

- The New York Stock Exchange( NYSE)

- The London Stock Exchange( LSE).

The forex market structure.

Unlike the Stock Exchange Market , the Forex Market structure is a decentralized market.

In the forex market, traders do transactions over the counter (OTC). There fore, the FX market has no central exchange through which it trades its instruments.

It is competitively comprised of the price makers, the dealers and traders of different liquidity sizes. The banks and brokers facilitate currency trades.

Not only do the banks and brokers facilitate trades but also provide different buy and sell quotes of different currency pairs and matching orders with the other traders.

The main participants are the large international banks, financial centers around the world, brokers and speculators.

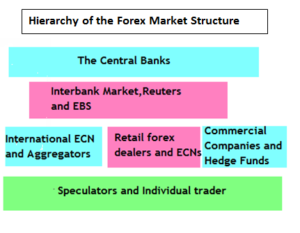

The forex market structure hierarchy is divided basing on the classification of participants, their motivation, regulations and the level of liquidity they hold at each level.

Forex Market Structure Hierarchy

At the top is the inter-bank forex market. These are the major banks and large commercial banks.

The major banks are the largest contributors in the market.

These include:

- Deutsche Bank

- UBS,

- Citi Group

- Barclays Capital

- Morgan

- Credit Suisse

- RBS

- Goldman Sachs

- HSBC

- Bank Of America

- Morgan Stanley.

The inter-banks determine exchange rates of currencies basing on their needs of supply and demand. The bank network consists of the world’s central banks, major banks and a number of smaller banks.

They all trade directly with one another using the Electronic Networks; the Reuters Dealing 3000-Spot Matching and Electronic Brokering Services(EBS).

Apart from trading among themselves, the inter-banks also provide liquidity to the market to facilitate transactions.

All in all, the inter banks are the market makers.

In addition to that, prices in this network is good and only members can benefit from it.

The financial and non-financial participants.

The financial and non-financial institutions include;

- Forex brokers( STP/ECN)

- Small banks

- Hedge funds

- Mutual funds

- Pension funds

- CTAs

- Large investors.

These institutions don’t make the transactions with the inter-bank market, but instead, they do via commercial banks.

This means that their rates are slightly higher and more expensive than those who are part of the inter-bank market.

These institutions, especially the brokers, receive liquidity from the large banks and make it available for the traders.

The brokers act as the intermediaries between the individual forex traders and the forex market marker.

Lastly, the speculators/retail traders.

Qn: Who are the speculators?

Ans: You and me.

Market Speculators/RETAILERS.

The market speculators/retailers are the ones who place their trades via forex brokers. These are at the bottom of the forex market structure.

They trade on quotes made by the dealers or ECN who are the liquidity providers in the retail market.

The number of traders in this hierarchy is extremely high.

However, when it comes to the volume they trade, it is significantly lesser when compared to banks and hedge funds. This is because, traders can trade on relatively small accounts as low as $10.

Traders speculate the market movements basing on technical and fundamental analysis to trade.

Most participants in this hierarchy are mostly daily traders who hold trades for days, hours, minutes even seconds.

During the decades ago,It was very hard for small retail traders to engage in Forex trading. Trading was only meant for the big banks and large international companies.

But nowadays, Since the emerging of the internet, electronic trading, and retail brokers, anyone can trade in the Forex market. The difficult barriers to enter Forex are no more.

Thanks to internet,things are now easy for you and me to make extra credit taking part in forex trading online.

The government or the central bank.

The Central Bank plays in the background of the market and controls the value of the currency.

Its role is to provide currency price stability, diversify forex reserves and make international payments on behalf of the government.

The central banks influence the forex market through exchange rates interventions.

- They increase and reduces interest rate following different economic dynamic factors..

- The central banks can also use monetary policy,(expansional monetary policy and contractional monetary policy) interventions.

- In some case,they can also actively buy or sell their currency to affect the exchange rates.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post