Stochastic Oscillator in forex is a momentum indicator that compares the most recent closing price relative to the previous price range over a certain period of time.

The stochastic indicators also indicates overbought and oversold conditions on a scale of 0 – 100%. It therefore helps traders to know when the trend is coming to an end.

Stochastic indicator bases on an assumption that, closing prices tend to concentrate in the higher parts of the period range in a strong uptrend. Also, near the extreme of low of the period range for a downtrend.

This indicator was developed by George Lane in 1950s. It compares currency closing prices over a given period.

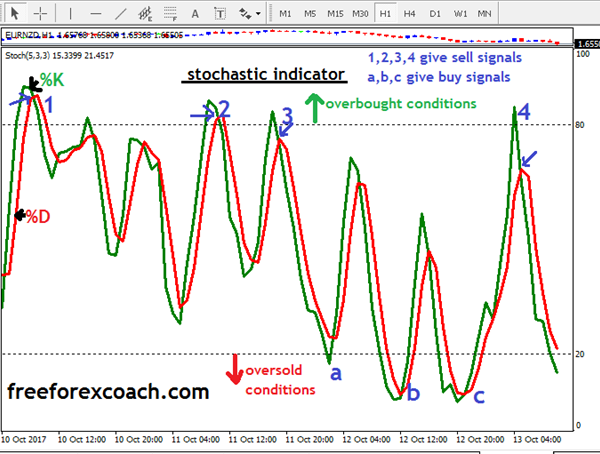

stochastic oscillator in forex

The stochastic indicator has 2 lines, %K and %D.

Stochastic lines run on the scale of 0 – 100%.

When the lines cross to 80 -100 area, the indicators shows market overbought conditions.

On the other hand, when the indicators crosses to 0 – 20% area, it shows market oversold conditions.

The default setting for stochastic indicator is 14 periods, it can be hours days weeks or months.

Below is the stochastic Oscillator in Forex on a chart.

When;

The readings are above 80%, %K line crosses over %D line. If both lines are pointing down, it indicates a sell signal.

Similarly, if the two lines cross and are both pointing up when the stochastic reading is below 20%, that gives a buy signal.

Trading when the market shows overbought conditions

When the Stochastic oscillator is over 80, it means that the price is overbought. The overbought market has a high chance of going down.

An overbought market condition happens after a strong rise of prices in an uptrend.

Remember, Momentum shifts directions when these two stochastic lines cross.

On the chart above, the %K is the green line and the %D is the red line.

When these two lines cross, it is a sign that the market direction is likely to change.

Therefore, If %K rises above %D above 80%, and crosses it pointing down, it indicates a sell signal.

For instance, from the chart above;

You would take a sell signal when the green line crosses the red line pointing down. The sell signals are indicated with numbers from 1 – 4.

In short, a cross to the downside that occur above 80 indicates a potential shift in trend down from overbought levels.

You take a signal that is in the direction of the cross.

Trading when the market shows oversold conditions

Likewise, a cross up that occurs below 20 would indicate a potential shifting trend higher from oversold levels.

An oversold condition occurs after a long downtrend.

Like we said earlier, the stochastic oscillator comprises of two lines on the chart, the %K (green line) and the %D (the red line) on the above chart.

If %K falls lower than %D below 20%, then crosses it pointing up, it indicates a buy signal.

Therefore, considering the chart above, we would consider a, b and c as our buy signals.

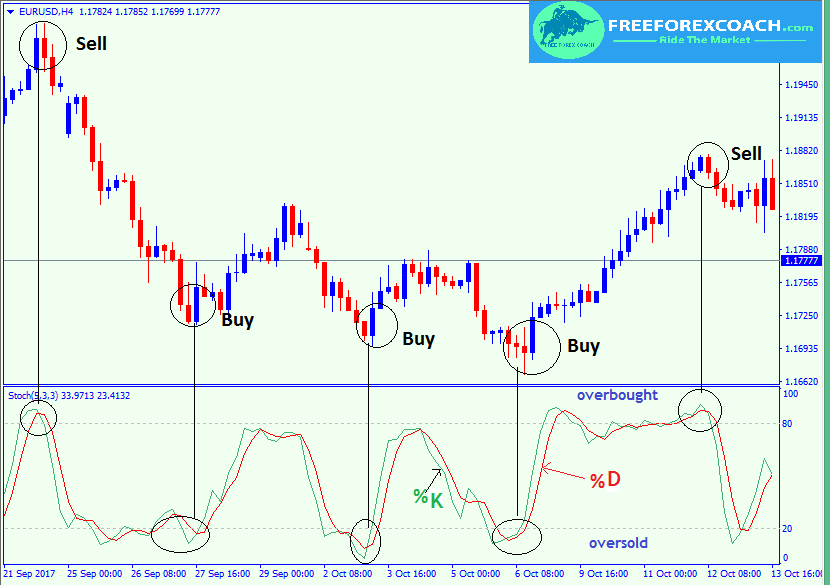

Let’s now look at an example on the chart below;

From the chart above,

crosses in the overbought area above 80 give sell signals.

crosses below the 20% level in the oversold area, give buy signals.

However, it is always important to remember that overbought and oversold readings are not completely accurate indications of a reversal all the time.

The Stochastic indicator can remain above 80 or below 20 for long periods of time, so just because the indicator says “overbought” doesn’t mean you should blindly sell!

The same thing if you see “oversold”, it doesn’t mean you should jump into a trade and buy.

Stochastic indicators can be used to determine the probable price reversal point.

This is why it’s important to always use the stochastic oscillator combined with other technical analysis indicators. Also add a risk management strategy.

We will discuss the details on how to trade multiple indicators in next sessions.

Trading Divergences using Stochastic oscillator in forex

Another way to trade stochastic indicator is looking at the price movements in relation to stochastic movements.

Divergences. This helps you to know when a trend is coming to an end.

Like we discussed in the previous sessions, Divergence occurs when the market price makes a lower low/higher high but the indicator doesn’t.

A Bullish divergence;

It happens when the market price forms a lower low, but the stochastic oscillator forms a higher low.

In this situation, the market trend is likely to reverse to the upside. Buy signal

Bearish divergence;

This happens when the market price forms a higher high, but the stochastic oscillator forms a lower high.

Possible reversal to the downside hence sell signal.

Let’s look at the chart below,

In the above example, we have a bullish divergence.

You can now tell the difference between the lows.

Price made a lower low and the Stochastic made a higher low.

Following the signal, it would be a good time to buy.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post