Types of Divergences in Forex are disagreements between Oscillators & Price.

Technical Analysis traders use oscillators to measure price momentum and at the same time to generate market direction signals.

These oscillators always move in the same direction as price. However, we sometimes come across some scenarios where it’s not the case.

This kind of disagreement is known as a divergence.

What is divergence in forex trading

A divergence forms on a chart when price makes a higher high, but the oscillator makes a lower high.

Similarly, price makes lower low but the oscillator makes higher low.

In this situation, the oscillator and price action are not in agreement.

Price and momentum oscillators always move hand in hand in the same direction.

As prices make higher highs, indicators should also make higher highs and as it makes lower lows, indicators should do the same.

When there is a difference in the movement of indicators and prices, then something is fishy in the market . That, requires your attention.

The disagreement between the oscillator and price signals a potential change in price momentum and this may result to a change in trend.

In order to spot the divergences in the Forex markets, you have to compare price movement to an oscillator movement.

The most commonly used oscillators include:

- MACD

- RSI

- Stochastics

- Willians %R

Types of Divergences in forex are easy to spot in the market and form on all time frames .

You can use divergences to identify trend reversals and generate trade signal set ups.

You can also rely on them to determine the entry points and exit points.

Types of divergences

- Regular divergences

- Hidden divergences

Regular divergences

This is When price action hits higher highs or lower lows and momentum oscillators doesn’t.

For example,

When price makes a higher high but the indicator forms a lower high, that shows the bulls are losing momentum.

Expect a fall in prices in the due time.

Similarly,

When the price falls to a lower lows but the oscillator gets slower and makes higher lows, there is a problem with the bears.

They are losing momentum and the price is likely to rise.

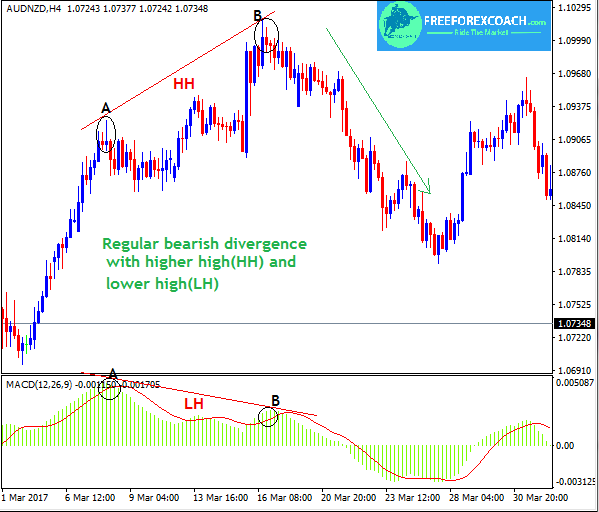

Regular bearish divergence.

For an uptrend, if price is making higher highs and the oscillator makes lower highs, this is a regular bearish divergence.

Here is an example

The change in momentum shows a weakness in the buyers as the oscillator strikes lower highs or starts forming fake double or triple tops.

This signals a possible downtrend reversal.

At this point price is likely to fall giving bears an excite mood to open short positions.

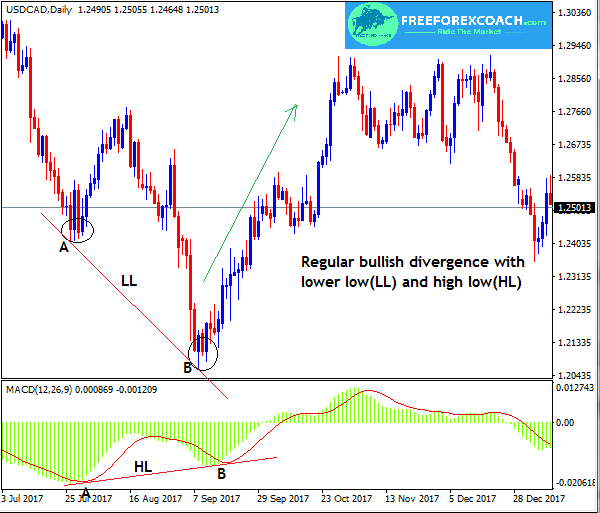

Regular bullish divergence:

This normally appears at the end of a downtrend.

Take a look on the chart below

When price makes lower lows and the oscillator makes higher lows, the disagreement between the two is known as a regular bullish divergence.

It is an indication of a fall in momentum in a downtrend signaling change in trend

As the oscillator struggles to make higher lows or false double or triple bottoms, buyers should be preparing for long positions for this might be the end of a downtrend.

Hidden divergences

Unlike the regular divergences, hidden divergence forms on the oscillators.

Hidden divergences are not strong reversal points like the regular divergences.

They may shift the trend for sometime and then the trend continues in its direction or cause no change at all.

Hidden bearish divergences:

This appears inform of a correction during a downtrend.

Example on Chart

The oscillator strikes higher high but price forms a lower high or maintains its previous point.

The trend is still strong and may continue in its direction after the completion of the consolidation.

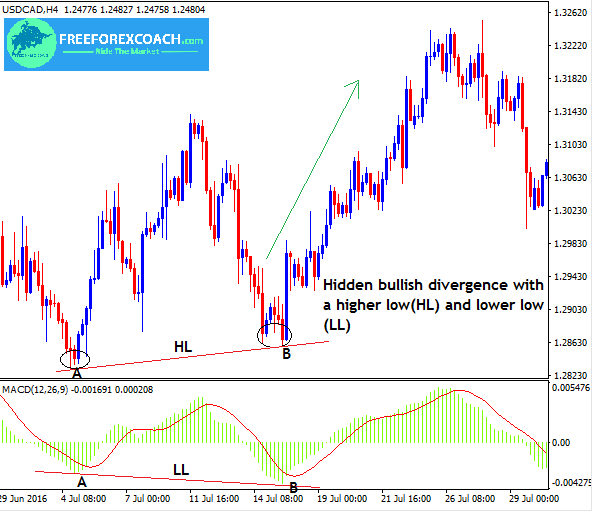

Hidden bullish divergence:

This forms during an uptrend.

Example on Chart

As the oscillators make lower lows, price only affords the higher lows or maintains its previous points for a consolidation.

The trend is likely to continue after a while.

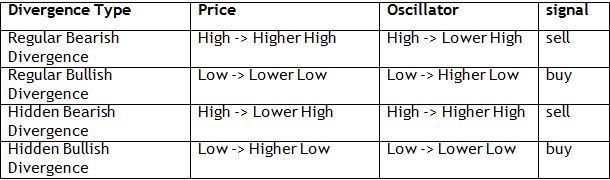

Divergence Table (Price and Oscillator)

Sometimes these types of divergences in forex may appear exaggerated while perfecting the technical indicator of the double or triple tops or bottoms.

For technical, the last top is slightly lower than the first.

When price forms tops or bottoms on the same line with a divergence on the oscillator, it’s a signal for a trend continuation.

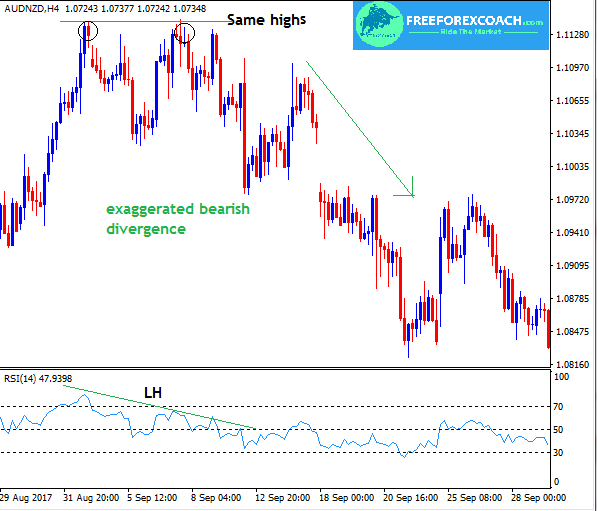

The exaggerated bearish divergence:

This where price forms two tops almost the at the same line but the indicator diverges with its second top is lower than the first one.

When in a downtrend, it gives a signal that the downtrend is still strong. On the other hand, when formed at the end of an uptrend, it may lead to reversal.

Let’s have a look at an example on the chart.

Exaggerated bullish divergence

The exaggerated bullish forms when price forms two bottoms almost same level as the indicator forms bottoms with the second one higher than the first.

It gives a signal for a strong continuation of an uptrend or a reversal when formed at the end of a downtrend.

When this appears, you can either continue holding your open long position or open a new position.

Example on Chart

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post